Tag: Income Tax Exemption Limit

![Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19] Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19]](https://www.staffnews.in/wp-content/uploads/2018/05/income-tax-ay-2019-20-fy-2018-19-tax-rates-relief-exemption-deductions.jpg)

Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19]

INCOME TAX

Benefits available only to Individuals & HUFs

Assessment Year 2019-20 [Financial Year 2018-19]

A. Tax Rates and Reli [...]

![Income Tax – List of benefits available to Salaried Persons for Assessment Year 2018-19 [FY 2017-2018] Income Tax – List of benefits available to Salaried Persons for Assessment Year 2018-19 [FY 2017-2018]](https://www.staffnews.in/wp-content/uploads/2018/05/Income-Tax-ListofbenefitsavailabletoSalariedPersons-AY-2018-19.jpg)

Income Tax – List of benefits available to Salaried Persons for Assessment Year 2018-19 [FY 2017-2018]

INCOME TAX

List of benefits available to Salaried Persons

[AY 2018-19]

S. N.

Section [...]

Clarification regarding applicability of standard deduction of Rs.40,000 to pension received from the former employer

Clarification regarding applicability of standard deduction of Rs.40,000 to pension received from the former employer – Ministry of Finance

[...]

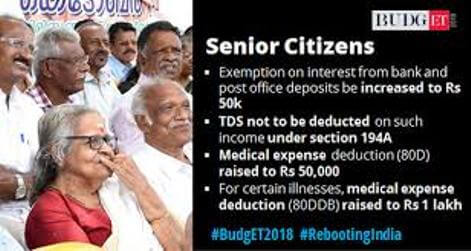

Budget – Relief to Senior Citizens वरिष्ठ नागरिकों को राहत – Income Tax Section 80D, 80DDB & 80TTB

Budget - Relief to Senior Citizens वरिष्ठ नागरिकों को राहत - Income Tax Section 80D, 80DDB & 80TTB

Press Information Bureau

Government [...]

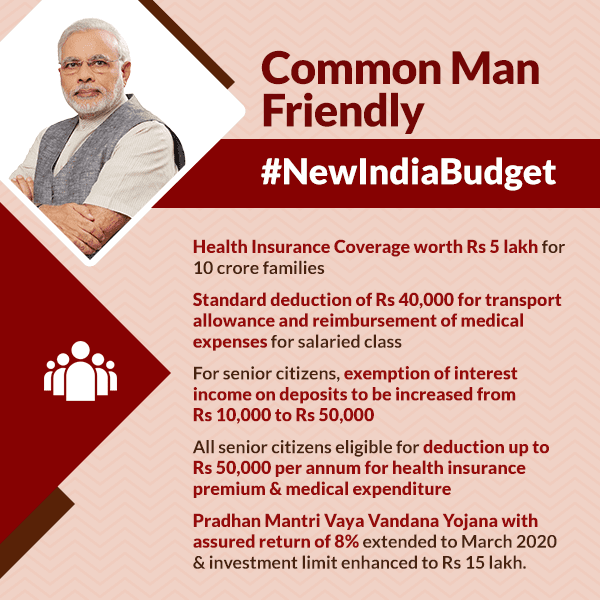

Budget: Relief to salaried taxpayers: standard deduction of Rs 40,000 allowed in lieu of present exemptions वेतनभोगी कर दाताओं को राहत : वर्तमान कटौतियों के बदले 40,000 रुपए की मानक कटौती

Budget: Relief to salaried taxpayers: standard deduction of Rs 40,000 वेतनभोगी कर दाताओं को राहत : 40,000 रुपए की मानक कटौती

Press Informati [...]

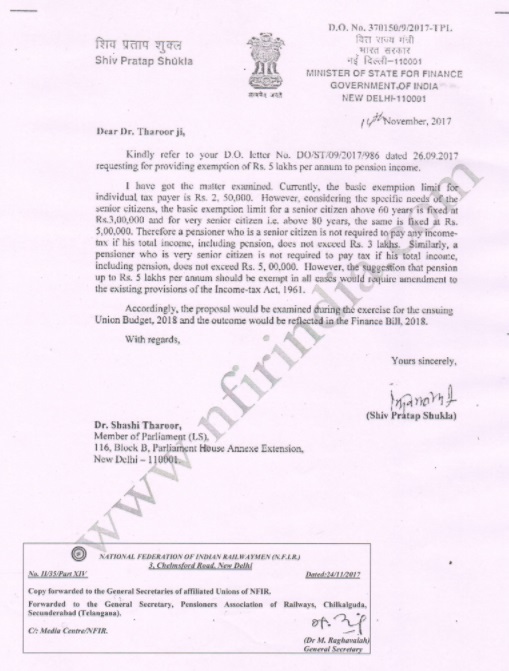

Exemption of Pension up to Rs. 5 lakhs per annum from Income Tax: Proposal will be examined – MoS for Finance

Exemption of Pension up to Rs. 5 lakhs per annum from Income Tax: Proposal will be examined - MoS for Finance.

Shiva Pratap Shukla

D.O. No. [...]

Asadharan Suraksha Seva Praman Patra: Income Tax Notification dated 30.08.2017

Asadharan Suraksha Seva Praman Patra: Income Tax Notification dated 30.08.2017

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DI [...]

Requirement of tax deduction at source in case of entities whose income is exempted under Section 10 of the Income-tax Act, 1961 – Exemption thereof.

Requirement of tax deduction at source in case of entities whose income is exempted under Section 10 of the Income-tax Act, 1961 – Exemption thereof [...]

Exemption of Income Tax to the pensioners/family pensioners who have been granted with Gallantry Awards: PCDA Circular No. 188

Exemption of Income Tax to the pensioners/family pensioners who have been granted with Gallantry Awards: PCDA Circular No. 188

Office of the Princi [...]

Whether the withdrawal from National Pension Scheme is taxed to the extent of 60 percent

Whether the withdrawal from National Pension Scheme is taxed to the extent of 60 per cent: Yes, Govt said in Parliament

GOVERNMENT OF INDIA

MINIST [...]