Tag: Income Tax Exemption Limit

Exemption from payment of income tax to Pensioners who have attained age of 80 years or more: Agenda Item 47th NC(JCM) Meeting

Exemption from payment of income tax to Pensioners who have attained age of 80 years or more: Agenda Item 47th NC(JCM) Meeting

[Part of the Minute [...]

Exempt the Island Special Duty allowance, NER Special Duty Allowance from the purview of income tax: Agenda Item 47th NC(JCM) Meeting

Exempt the island special duty allowance, special duty allowance granted to employees in the north eastern region from the purview of income tax: Ag [...]

Exempt transport allowance & running allowance from income-tax: Agenda Item 47th NC(JCM) Meeting

Exempt transport allowance & running allowance from income-tax: Agenda Item 47th NC(JCM) Meeting

[Part of the Minutes of the 47th Meeting of N [...]

Gazzette Notification: Exemption u/s 10 of Income Tax – Rs. 20 Lakh for Gratuity w.e.f. 29.03.2018

Gazzette Notification: Exemption u/s 10 of Income Tax - Rs. 20 Lakh for Gratuity w.e.f. 29.03.2018

असाधारण

EXTRAORDINARY

भाग 1---खण्ड 3 [...]

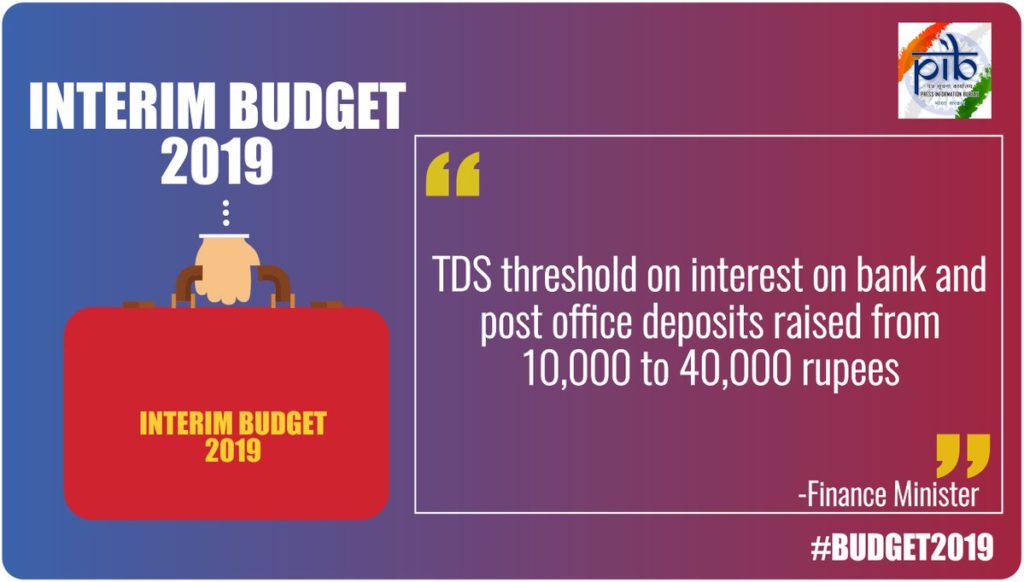

Budget 2019-20: No Tax upto Rs.5 Lakh, 1.5 Lakh for Saving, Standard Deduction Rs.50,000 & Bank Interest TDS threshhold Rs. 40,000

Budget 2019-20: No Tax upto Rs.5 Lakh, 1.5 Lakh for Saving, Standard Deduction Rs.50,000 & Bank Interest TDS threshhold Rs. 40,000

Indi [...]

Gazette Notification: ECHS for the purposes of Section 80D of IT Act, 1961 for the A.Y. 2019-20 & subsequent assessment years.

Gazette Notification: ECHS for the purposes of Section 80D of IT Act, 1961 for the A.Y. 2019-20 & subsequent assessment years..

MINISTRY OF FI [...]

Income Tax: Allowances available to different categories of Tax Payers and limit of exemption [AY 2019-20]

Income Tax: Allowances available to different categories of Tax Payers and limit of exemption [AY 2019-20]

Income Tax

Allowances available to di [...]

Income Tax: Income under the House Properties – Computation, Deduction for interest on housing loan

Income Tax: Income under the House Properties - Computation, Deduction for interest on housing loan

Income under the House Properties

2.1 [...]

Section 80D of IT Act – Inclusion of Contributory Health Service Scheme of the Department of Atomic Energy

Section 80D of IT Act - Inclusion of Contributory Health Service Scheme of the Department of Atomic Energy

MINISTRY OF FINANCE

(Department o [...]

![Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018] Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018]](https://www.staffnews.in/wp-content/uploads/2018/05/tax-treatment-of-income-under-head-salary.jpg)

Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018]

Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018]

Treatment of Income under the head Salaries

1.1 Salary is [...]