Tag: Income tax calculation

Change in TDS Return Form 26Q & Form 27Q – Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

Change in TDS Return Form 26Q & Form 27Q - Income-tax (16th Amendment) Rules, 2020 IT Notification No. 43/2020

THE GAZETTE OF INDIA : EXTRAORDI [...]

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

No. 24/06/2020-Cash (MS) [...]

Option u/s 115BAC under New Tax Regime: Amendment Notification No. 38/2020 regarding Allowances and Perquisites allowable to assessee

Option u/s 115BAC under New Tax Regime: Amendment Notification No. 38/2020 regarding Allowances and Perquisites allowable to assessee

MINISTRY OF [...]

Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

No.G-26028/4/2020-Cash

Government of India

Ministr [...]

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Taxation Sect [...]

Income other than business or profession – Clarification on option u/s 115BAC of IT Act 1961: Circular C1 of 2020

Income other than business or profession - Clarification on option u/s 115BAC of IT Act 1961: Income Tax Circular C1 of 2020 dated 13.04.2020 issued b [...]

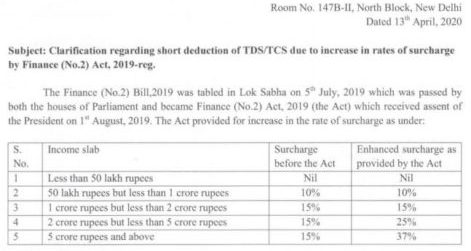

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

Ready Reckoner – Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime i.r.o. Normal, Senior & Super Senior Citizen

Ready Reckoner - Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime calculated on Annual income starting from Rs.5 Lakh increas [...]

Income Tax – FAQs on Salary Income – Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Income Tax - FAQs on Salary Income - Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Frequently Asked Quest [...]

Exemption Free Income Tax Regime – Details छूट मुक्त आयकर प्रणाली – ब्यौरा

Exemption Free Income Tax Regime - Details छूट मुक्त आयकर प्रणाली - ब्यौरा

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

LOK SABHA

UNSTARRED

QUESTION N [...]