Tag: gpf

State Railway Provident Fund – Rate of interest during the year 2017-18 (July, 2017 – September, 2017)

State Railway Provident Fund - Rate of interest during the year 2017-18 (July, 2017 - September, 2017)

RBE No. 98/2017

GOVERNMENT OF INDIA (BHAR [...]

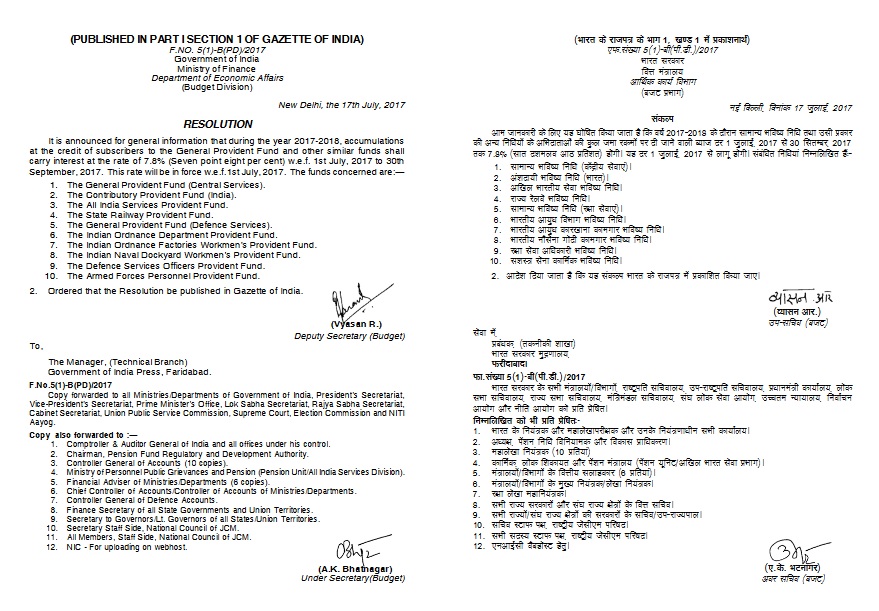

General Provident Fund & Similar funds: Rate of Interest wef 1st July 2017 to 30th September 2017 @ 7.8%

General Provident Fund: Rate of Interest wef 1st July 2017 to 30th September 2017 @ 7.8% - DoEA (Budget Division) Order

(PUBLISHED IN PART [...]

Allotment of GPF Account Numbers to Casual Labourers with temporary status: Clarification by DoP

Allotment of GPF Account Numbers to Casual Labourers with temporary status: Clarification by DoP

No. 01-07/2016-SPB-1

Government of India

Minis [...]

Amendment to the provisions of State Railway Provident Fund – liberalization of provisions for withdrawals from the Fund by the Subscribers

Amendment to the provisions of State Railway Provident Fund - liberalization of provisions for withdrawals from the Fund by the Subscribers

RBE No. [...]

GPF: CGA is preparing to provide facility of online application for change in subscription, advance, withdrawal, balance inquiry

GPF: CGA is preparing to provide facility of online application for change in subscription, advance, withdrawal, balance inquiry

Shifting of GPF M [...]

Implementation of new process of GPF advance and withdrawal payments to BSNL employees- reg.

Implementation of new process of GPF advance and withdrawal payments to BSNL employees- reg.

BHARAT SANCHAR NIGAM LIMITED

Corporate Office,

CA [...]

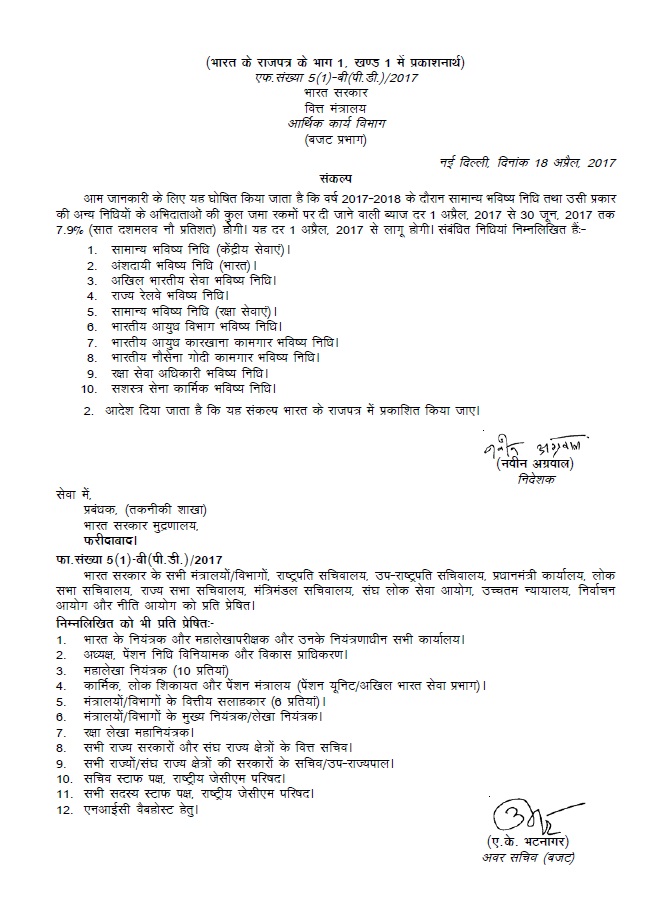

General Provident Fund Interest Rate @7.9% from 01.04.2017 to 30.06.2017: Fin Min Resolution

General Provident Fund Interest Rate @7.9% from 01.04.2017 to 30.06.2017: Fin Min Resolution

(PUBLISHED IN PART I SECTION 1 OF GAZETTE OF INDIA)

F [...]

LTC, CGHS, GPF, MA & Conduct Rules: Making service rules gender nutral सेवा नियमावली को महिला-पुरूष भेदभाव रहित बनाया जाना

LTC, CGHS, GPF, MA & Conduct Rules: Making service rules gender neutral सेवा नियमावली को महिला-पुरूष भेदभाव रहित बनाया जाना

GOVERNMENT OF INDIA [...]

Several relaxations brought in GP Fund rules

Several relaxations brought in GP Fund rules

Press Information Bureau

Government of India

Ministry of Personnel, Public Grievances & Pension [...]

Taxation on Transfer of amount from Provident Fund/Superannuation fund to NPS

Taxation on Transfer of amount from Provident Fund/Superannuation fund to NPS

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

B-14/A, Chhatrapati [...]