Tag: CBDT Order

Donation of one days salary to PM Cares Funds, every month till March 2021. Format of Intimation by CBDT

Donation of one days salary to PM Cares Funds, every month till March 2021. Format of Intimation by CBDT

Directorate of Human Resource Development

[...]

Income other than business or profession – Clarification on option u/s 115BAC of IT Act 1961: Circular C1 of 2020

Income other than business or profession - Clarification on option u/s 115BAC of IT Act 1961: Income Tax Circular C1 of 2020 dated 13.04.2020 issued b [...]

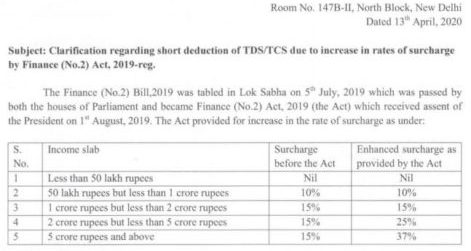

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS o [...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

Extension of due date for filing of IT Return/Tax Audit Reports to 30th November, 2019 i.ro. UT of J&K & Ladakh

Extension of due date for filing of Income-tax Returns/Tax Audit Reports to 30th November, 2019 in respect of Union Territory of Jammu and Kashmir and [...]

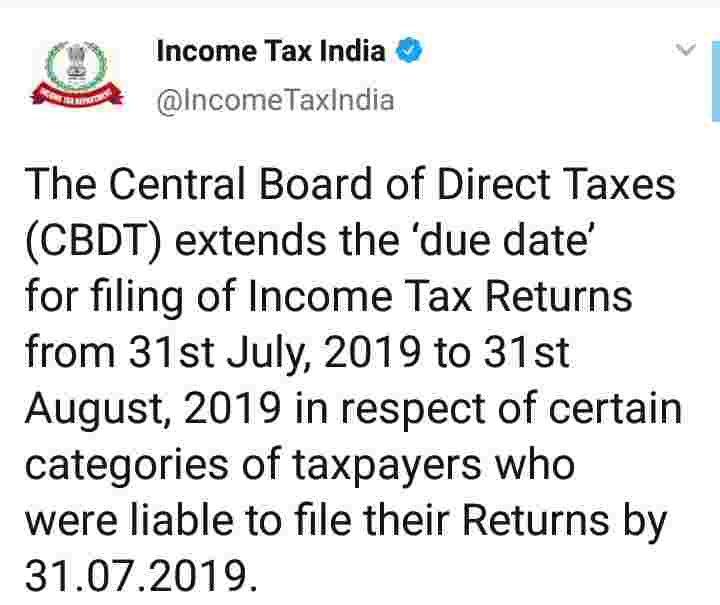

Extension of due date for filing of ITRs for the A.Y 2019-20 from 31st July, 2019 to 31st August, 2019 – Order u/s. 119 of the income-tax Act, 1961

Extension of due date for filing of ITRs for the A.Y 2019-20 from 31st July, 2019 to 31st August, 2019 - Order u/s. 119 of the income-tax Act, 1961 [...]

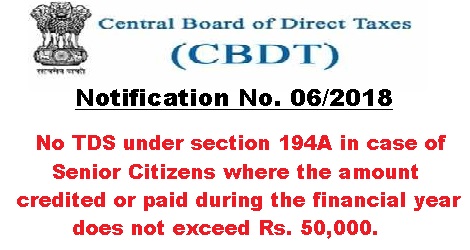

No TDS u/s 194A in case of Senior Citizens upto amount Rs. 50,000: CBDT Notification

No TDS u/s 194A in case of Senior Citizens upto amount Rs. 50,000: CBDT Notification

F. No. Pr. DGIT(S)/CPC(TDS)/Notification/2018-19 [...]

Tax Return Preparer Scheme – Amendment in Eligibility Qualification, Age, Fee and Remuneration

Tax Return Preparer Scheme - Amendment in Eligibility Qualification, Age, Fee and Remuneration

MINISTRY OF FINANCE

(Department of Revenue)

(CEN [...]

TDS certificates in the name of the deceased depositor is not in accordance with law: CBDT notification on TDS on interest on deposits made under the Capital Gains Accounts Scheme, 1988

TDS certificates in the name of the deceased depositor is accordance with law: CBDT notification on TDS on interest on deposits made under the Capita [...]