Category: INCOME TAX

Award Scheme for recognizing the best performing Aayakar Sewa Kendras

Award Scheme for recognizing the best performing Aayakar Sewa Kendras:-

F. No. 48/5/205/ASK Award/DOMS

Government of India, Ministry of Finance, D [...]

DGR Advisory: Mandatory Submission of Form Number 26AS of Income Tax

ADVISORY: MANDATORY SUBMISSION OF FORM NUMBER 26 AS OF INCOME TAX

1. Please refer to Para 10 of Dept of ESW, MoD Office Memorandum No 28(03)/2012 - [...]

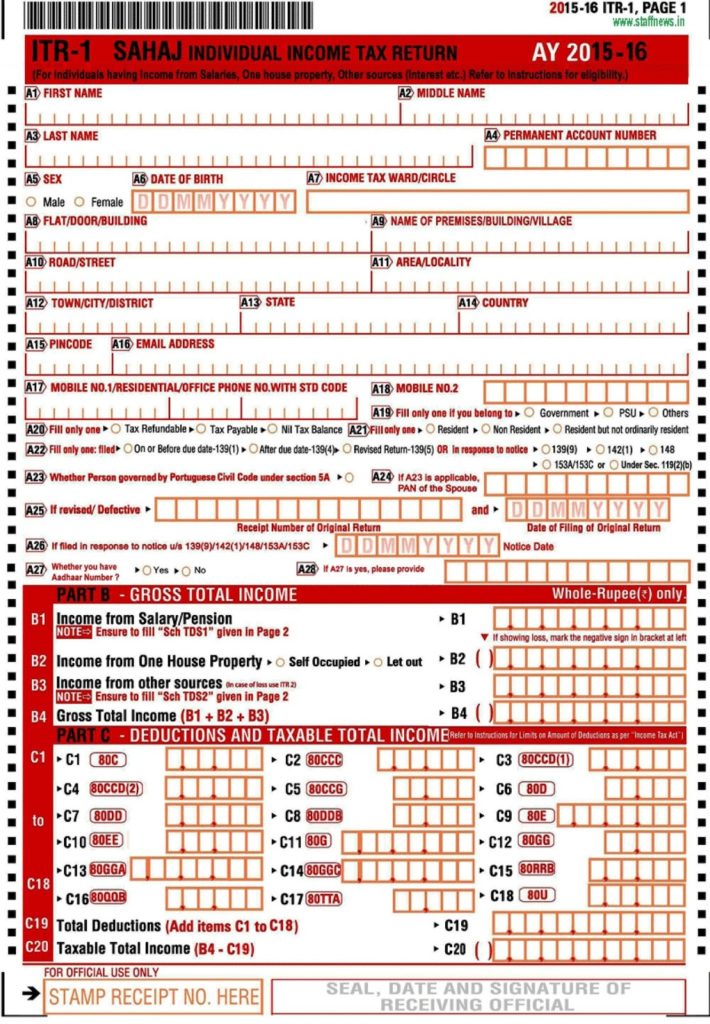

Income Tax Return Forms – ITR-1 Sahaj, ITR-2 & ITR-V Acknowledgement Form for AY 2015-16: New Form will be released

The Finance Ministry on Sunday came out with a new three-page Income Tax Return-1 (ITR-1) Sahaj forms with new ITR-1 and ITR-V (Acknowledgement) Form [...]

Income Tax Return Forms ITR 1, 2 and 4S Simplified: Time limit for filing returns to be extended up to 31st August, 2015

Income Tax Return Forms ITR 1, 2 and 4S Simplified: Time limit for filing returns to be extended up to 31st August, 2015

Press Information Bureau  [...]

Tax Relief To Family Members of Differently Abled: Section 80DD of IT Act

Press Information Bureau

Government of India

Ministry of Finance

24-April-2015 17:39 IST

Tax Relief To Family Members of Differently Abled

Sec [...]

Capital gains in respect of units of Mutual Funds under the Fixed Maturity Plans on extension of their term

Capital gains in respect of units of Mutual Funds under the Fixed Maturity Plans on extension of their term:-

F. No. 133/39/2014-TPL

Government of [...]

TDS on Recurring Deposits from June 1

TDS on recurring deposits from June 1 force investors to close down deposits prematurely

NEW DELHI: Days after the Budget announced that tax deduc [...]

Details of provision for Income Tax, TDS, Exemption limit in Budget 2015-16 – Finance Bill 2015

FINANCE BILL, 2015

PROVISIONS RELATING TO DIRECT TAXES

Introduction

The provisions of the Finance Bill, 2015 relating to direct taxes seek to [...]

No Change in the Rate of Personal Income-Tax and The Rate of Tax for Companies on Income in Financial Year 2015-16

Press Information Bureau

Government of India

Ministry of Finance

28-February-2015 13:07 IST

No Change in the Rate of Personal Income-Tax and The [...]

Personal Income Tax exemption may go up to Rs 5 lakh: Financial Express

Personal Income Tax exemption may go up to Rs 5 lakh

The Budget FY16 may carry an assurance, possibly fortified by a new insertion into the Income Tax [...]