Category: INCOME TAX

638 Declarations received and Rs.3770 Crore declared under the Black Money Act

638 Declarations received and Rs.3770 Crore declared under the compliance window under the Black Money Act

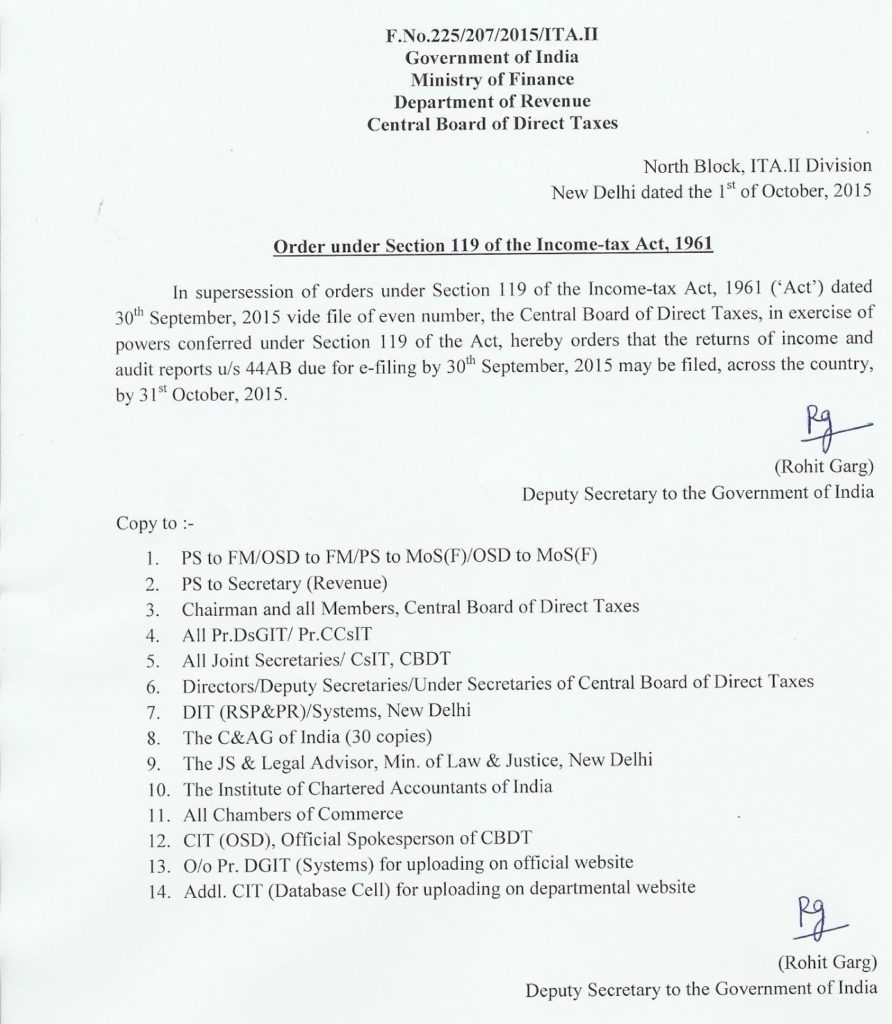

Government of India

Ministry of Finance [...]

The due date for ITR and audit reports u/s 44AB has been extended to 31st October 2015 for the entire country

The due date for ITR and audit reports u/s 44AB which were due by 30th September 2015 has been extended to 31st October 2015 for the entire country

[...]

High Courts direct CBDT to extend due date for filing of Tax Audit and Income Tax Return (ITR) to Oct 31st

Breaking; Punjab & Haryana, Gujarat HCs direct CBDT to extend due date for filing of Tax Audit and Income Tax Return (ITR) to Oct 31st

A divi [...]

Circulation of Fake order for extension of due date for filing of Audit report and return of Income for Assessment Year 2015-16- reg.

It has come to notice that a fake order regarding extension of due date for filing of audit reports and income tax returns beyond 30th September 201 [...]

Extension of due date of filing return of wealth for A.Y. 2015-16

Extension of due date of filing return of wealth for A.Y. 2015-16 - clarification

F.No.328/08/2015-WT

Government of India

Ministry of Finance

Dep [...]

Clarifications on Tax Compliance for Undisclosed Foreign Income and Assets: CBDT Circular No. 15 of 2015

Clarifications on Tax Compliance for Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015: CBDT

Circular No [...]

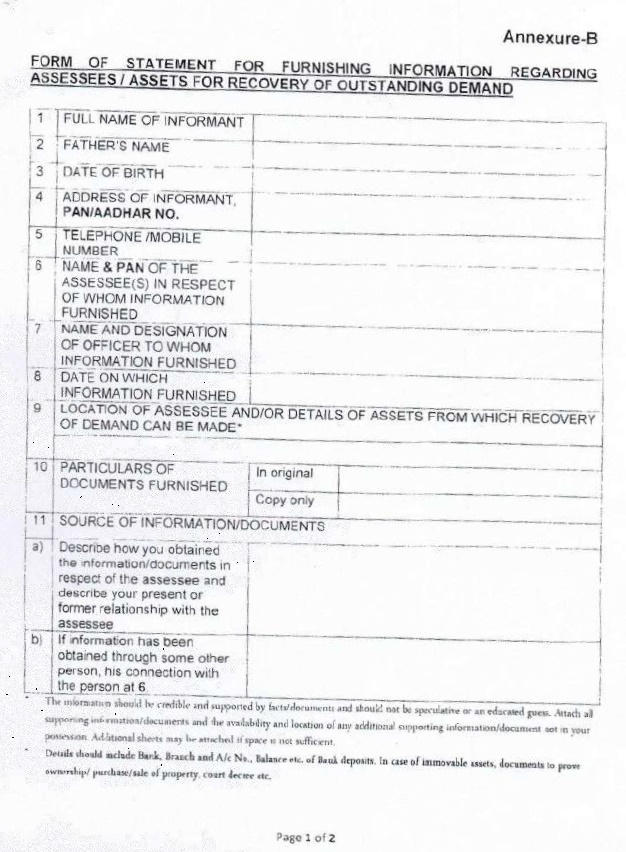

Guidelines for Grant of Reward to Informants leading to Recovery of Irrecoverable Taxes, 2015: CBDT Instruction No.07

Guidelines for Grant of Reward to Informants leading to Recovery of Irrecoverable Taxes, 2015

Instruction No.07/2015

F .No.385/21/2015-IT(B)

Govern [...]

Due-Date for E-Filing Returns of Income for AY 2015-16 Extended up to 7th September 2015 in Respect of all Taxpayers

Due-Date for E-Filing Returns of Income for AY 2015-16 Extended up to 7th September 2015 in Respect of all Taxpayers

Press Information Bureau&nbs [...]

ITR filing due date extended to 7th Sep 2015 for Gujarat State

Extension of due-date for filing Returns of Income from 31st Aug 2015 to 7th Sep 2015 in case of Income Tax assessees in the State of Gujarat: CBDT Or [...]

Special Income Tax Return Counters to be Organised for Salaried Tax Payers including Pensioners to File Paper Returns Between 24th August to 31st August, 2015

Press Information Bureau

Government of India

Ministry of Finance

21-August-2015 15:10 IST

Special Income Tax Return Counters to be Organised for [...]