Category: INCOME TAX

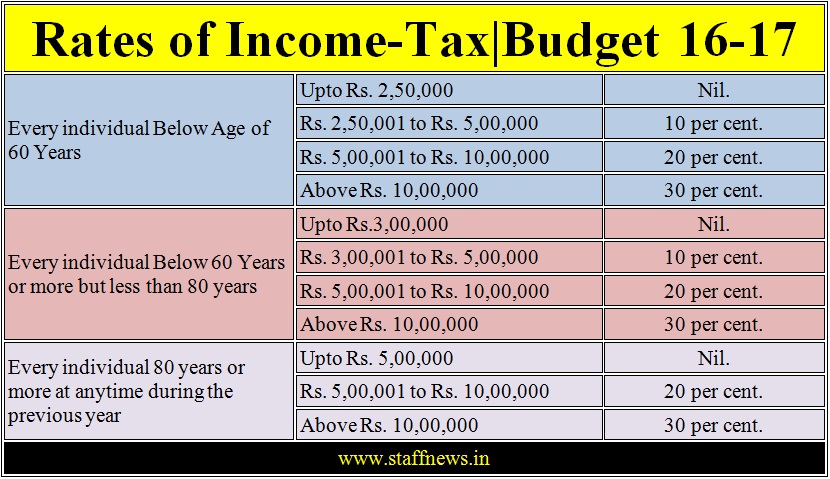

Rates of Income-Tax as per Union Budget 2016-17

BUDGET 2016-17 - FINANCE BILL, 2016

PROVISIONS RELATING TO DIRECT TAXES

A. RATES OF INCOME-TAX

I. Rates of income-tax in respect of income [...]

Tax exemption under Pension Scheme NPS EPF: Budget 2016-17

Tax exemption under Pension Scheme NPS EPF: Budget 2016-17

Press Information Bureau

Government of India

Ministry of Finance

29-February-2016 1 [...]

Income Tax in Budget: Tax Rebate u/s 87A increased, Deduction of Additional Interest of Rs.50,000 for First Home buyers

Tax Rebate u/s 87A increased, Deduction of Additional Interest of Rs.50,000 for First Home buyers

Press Information Bureau

Government of I [...]

Redressal of Taxpayer grievances raised due to TDS mismatches

Redressal of Taxpayer grievances raised due to TDS mismatches - Reg.

DIRECTORATE OF INCOME TAX (SYSTEM)

ARA Center, Ground Floor, E-Z, Ihandewalan [...]

E-filing of Income Tax Return: Additional modes of generating Electronic Verification Code (EVC)

Additional modes of generating Electronic Verification Code (EVC) have been notified in addition to EVC notified vide earlier Notification No. 2/201 [...]

Tax relief expenditure on serious diseases

Tax relief expenditure on serious diseases

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

LOK SABHA

UNSTARRED QUESTION No. 114 [...]

Allowability of employer’s contribution to funds for the welfare of employees in terms of section 43B(b) of the Income Tax Act

Allowability of employer’s contribution to funds for the welfare of employees in terms of section 43B(b) of the Income Tax Act: CBDT clarifies Due da [...]

Calculation of Income Tax – Illustrations – FY 2015-16 AY 2016-17: IT Circular 20/2015

Calculation of Income Tax to be deducted -Illustrations - FY 2015-16 AY 2016-17: IT Circular 20/2015

9. CALCULATION OF INCOME-TAX TO BE DEDUCTED

[...]

TDS on payment of accumulated balance under recognised Provident Fund & Superannuation Fund: IT Circular 20/2015

TDS on payment of accumulated balance under recognised Provident Fund & Superannuation Fund: IT Circular 20/2015

7 TDS ON PAYMENT OF ACCUMULAT [...]

Section 87A – Rebate of Rs. 2000 for Income upto Rs. 5 Lakh: IT Circular 20/2015

Section 87A - Rebate of Rs. 2000 for Income upto Rs. 5 Lakh: IT Circular 20/2015

6. REBATE OF Rs 2000 FOR INDIVIDUALS HAVING TOTAL INCOME UPTO R [...]