Category: INCOME TAX

Section 80D of IT Act – Inclusion of Contributory Health Service Scheme of the Department of Atomic Energy

Section 80D of IT Act - Inclusion of Contributory Health Service Scheme of the Department of Atomic Energy

MINISTRY OF FINANCE

(Department o [...]

![Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018] Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018]](https://www.staffnews.in/wp-content/uploads/2018/05/tax-treatment-of-income-under-head-salary.jpg)

Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018]

Income Tax: Treatment of Income under the head Salaries [As amended by Finance Act, 2018]

Treatment of Income under the head Salaries

1.1 Salary is [...]

![Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19] Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19]](https://www.staffnews.in/wp-content/uploads/2018/05/income-tax-ay-2019-20-fy-2018-19-tax-rates-relief-exemption-deductions.jpg)

Income Tax Rates, Relief, Exempted Income, Deduction, TDS & Advance Tax: INCOME TAX AY 2019-20 [FY 2018-19]

INCOME TAX

Benefits available only to Individuals & HUFs

Assessment Year 2019-20 [Financial Year 2018-19]

A. Tax Rates and Reli [...]

![Income Tax – List of benefits available to Salaried Persons for Assessment Year 2018-19 [FY 2017-2018] Income Tax – List of benefits available to Salaried Persons for Assessment Year 2018-19 [FY 2017-2018]](https://www.staffnews.in/wp-content/uploads/2018/05/Income-Tax-ListofbenefitsavailabletoSalariedPersons-AY-2018-19.jpg)

Income Tax – List of benefits available to Salaried Persons for Assessment Year 2018-19 [FY 2017-2018]

INCOME TAX

List of benefits available to Salaried Persons

[AY 2018-19]

S. N.

Section [...]

Clarification regarding applicability of standard deduction of Rs.40,000 to pension received from the former employer

Clarification regarding applicability of standard deduction of Rs.40,000 to pension received from the former employer – Ministry of Finance

[...]

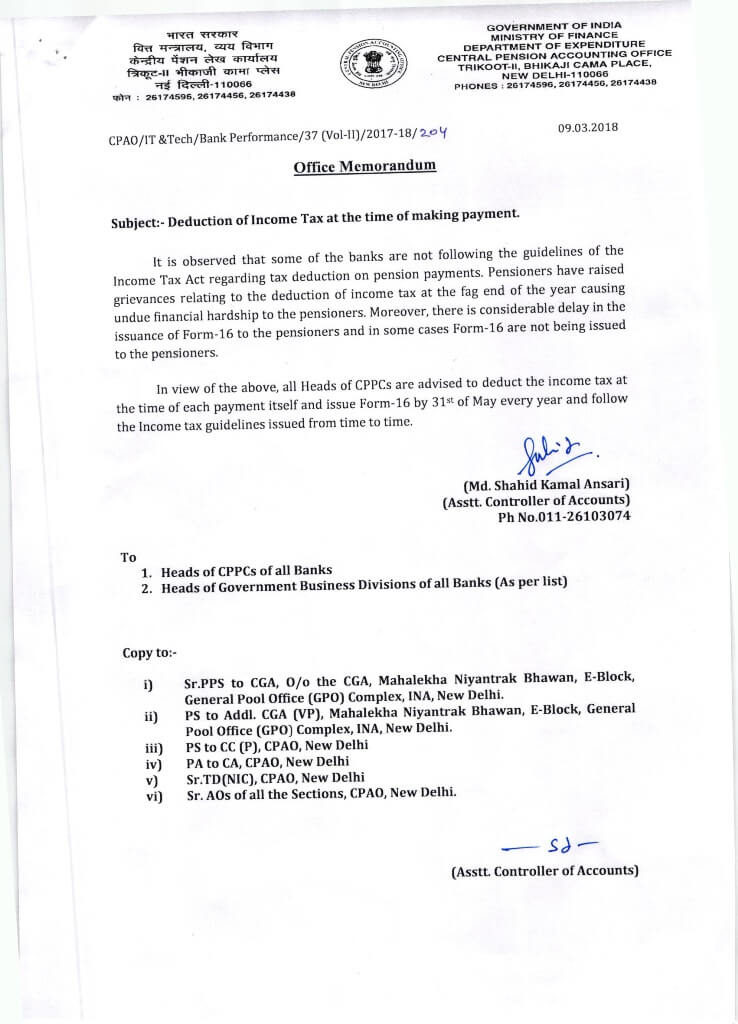

CPAO to Bank: Deduction Income Tax at the time of each payment of pension and issue Form-16 latest by May of every year

Deduction Income Tax at the time of each payment of pension and issue Form-16 latest by May of every year

केन्द्रीय पेन्शन लेखा कार्यालय, न [...]

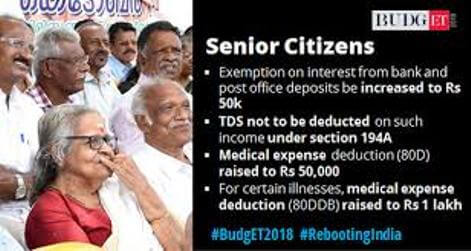

Budget – Relief to Senior Citizens वरिष्ठ नागरिकों को राहत – Income Tax Section 80D, 80DDB & 80TTB

Budget - Relief to Senior Citizens वरिष्ठ नागरिकों को राहत - Income Tax Section 80D, 80DDB & 80TTB

Press Information Bureau

Government [...]

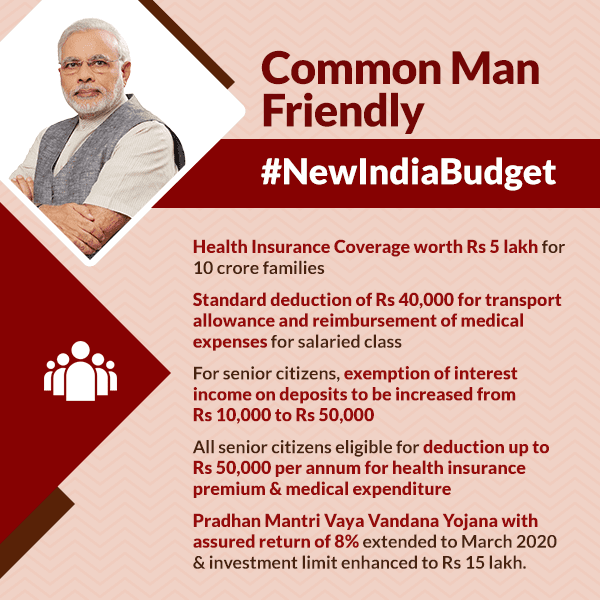

Budget: Relief to salaried taxpayers: standard deduction of Rs 40,000 allowed in lieu of present exemptions वेतनभोगी कर दाताओं को राहत : वर्तमान कटौतियों के बदले 40,000 रुपए की मानक कटौती

Budget: Relief to salaried taxpayers: standard deduction of Rs 40,000 वेतनभोगी कर दाताओं को राहत : 40,000 रुपए की मानक कटौती

Press Informati [...]

Cash Deposited by Central Government Employees during demonetisation

Cash Deposited by Central Government Employees during demonetisation

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

LOK SABHA

UNSTARRED QUESTION [...]

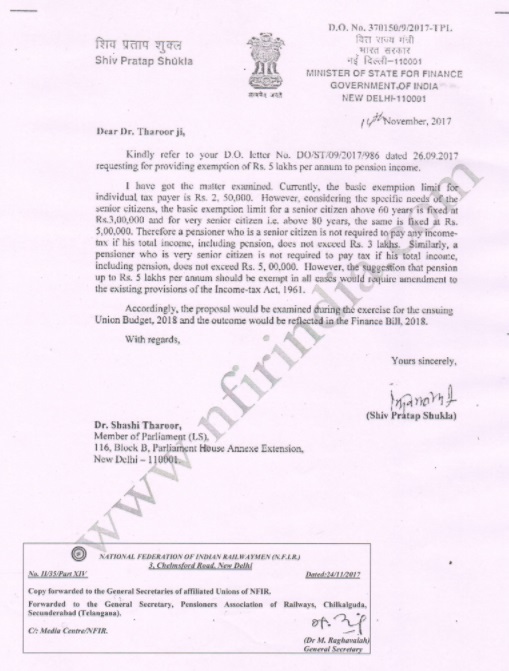

Exemption of Pension up to Rs. 5 lakhs per annum from Income Tax: Proposal will be examined – MoS for Finance

Exemption of Pension up to Rs. 5 lakhs per annum from Income Tax: Proposal will be examined - MoS for Finance.

Shiva Pratap Shukla

D.O. No. [...]