Category: INCOME TAX

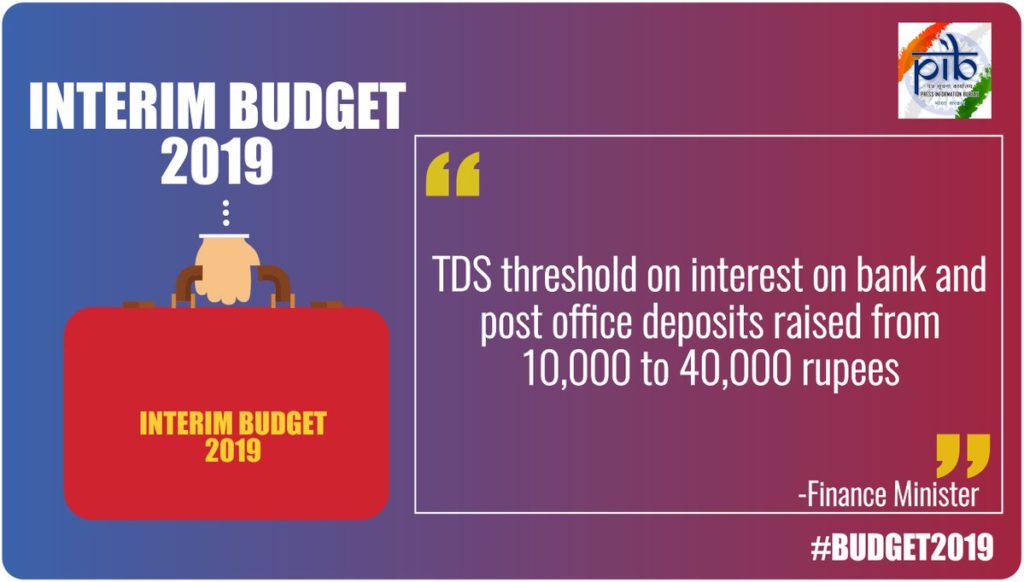

Budget 2019-20: No Tax upto Rs.5 Lakh, 1.5 Lakh for Saving, Standard Deduction Rs.50,000 & Bank Interest TDS threshhold Rs. 40,000

Budget 2019-20: No Tax upto Rs.5 Lakh, 1.5 Lakh for Saving, Standard Deduction Rs.50,000 & Bank Interest TDS threshhold Rs. 40,000

Indi [...]

Income Tax – Exclude Pension alongwith DR FMA: BPS writes to FM

Exclude Pension/family pension along with DR & FMA from the levy of income-tax - BPS writes to FM

No BPS/SG/pension/I.Tax/018/1

Dated: [...]

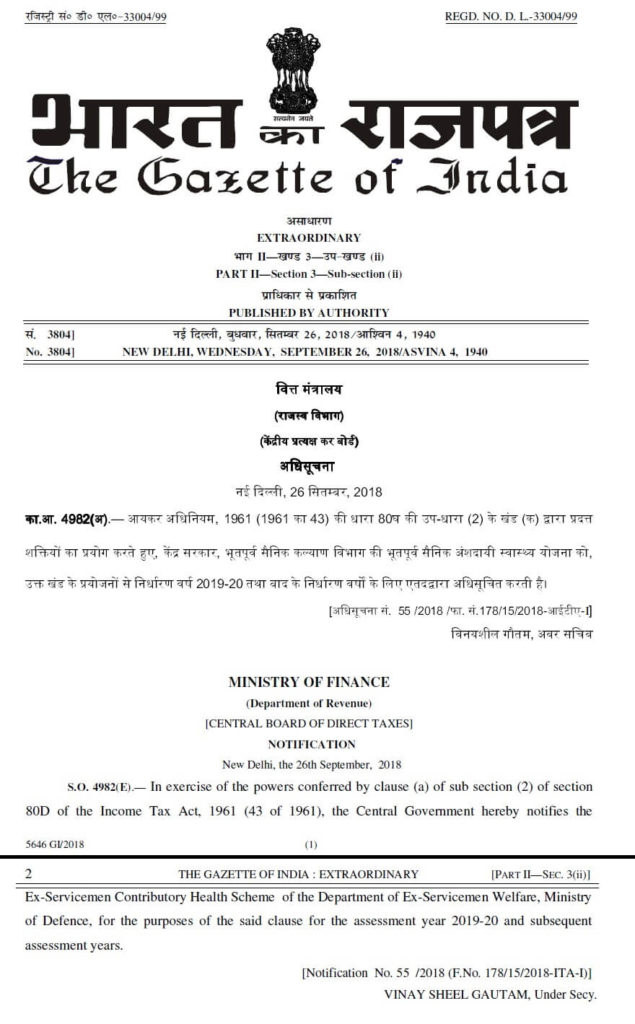

Gazette Notification: ECHS for the purposes of Section 80D of IT Act, 1961 for the A.Y. 2019-20 & subsequent assessment years.

Gazette Notification: ECHS for the purposes of Section 80D of IT Act, 1961 for the A.Y. 2019-20 & subsequent assessment years..

MINISTRY OF FI [...]

Extension of date for filing of Income Tax Returns for taxpayers in Kerala upto 15.09.2018

MoF: Extension of date for filing Income Tax for taxpayers in Kerala - Press Release

Ministry of Finance

Extension of date for filing of Inco [...]

Income tax return filing deadline extended by a month to August 31, 2018: CBDT Order u/s 119 of IT Act, 1961

Income tax return filing deadline extended by a month to August 31, 2018: CBDT Order u/s 119 of IT Act, 1961

F.No. 225/242/2018/ITA.II

Governmen [...]

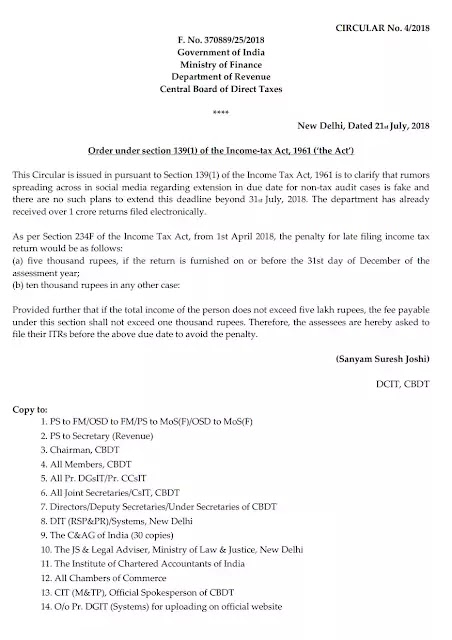

IT Circular No. 4 – No extension in due date for filing Income Tax Return

IT Circular No. 4 - No extension in due date for filing Income Tax Return

CIRCULAR No.4/2018

F.No.370889/25/2018

Government of Ind [...]

Revision of monetary limits for filing of appeals by the CBDT – Measures for reducing litigation

Revision of monetary limits for filing of appeals by the CBDT - Measures for reducing litigation

Circular No. 3/ 2018

F No 279 / Misc. 142/ 2007 [...]

Income Tax : Filling of Returns by every Government Servant – Reg

Income Tax : Filling of Returns by every Government Servant – Reg

भारत सरकार

/Government of India

आयकर विभाग/Income Tax Department

[...]

आयकर रिटर्न ई-फाइलिंग – ये तरीके अपनाकर घर बैठे आईटीआर भर सकेंगे

आयकर रिटर्न ई-फाइलिंग ये तरीके अपनाकर घर बैठे आईटीआर भर सकेंगे

नई दिल्ली | हिटी .

आयकर रिटर्न दाखिल करने का यह आखिरी महीना चल रहा है। भारी जुर [...]

Income Tax: Allowances available to different categories of Tax Payers and limit of exemption [AY 2019-20]

Income Tax: Allowances available to different categories of Tax Payers and limit of exemption [AY 2019-20]

Income Tax

Allowances available to di [...]