Category: INCOME TAX

Exempt the Island Special Duty allowance, NER Special Duty Allowance from the purview of income tax: Agenda Item 47th NC(JCM) Meeting

Exempt the island special duty allowance, special duty allowance granted to employees in the north eastern region from the purview of income tax: Ag [...]

Exempt transport allowance & running allowance from income-tax: Agenda Item 47th NC(JCM) Meeting

Exempt transport allowance & running allowance from income-tax: Agenda Item 47th NC(JCM) Meeting

[Part of the Minutes of the 47th Meeting of N [...]

Procedure for filing eTDS/TCS statement online through e-filing portal: CBDT Latest Notification No. 10/2019

Procedure for filing eTDS/TCS statement online through e-filing portal: CBDT Latest Notification No. 10/2019F. No. 1/3/7/CIT(OSD)/E-FILING/TDS/TCS FO [...]

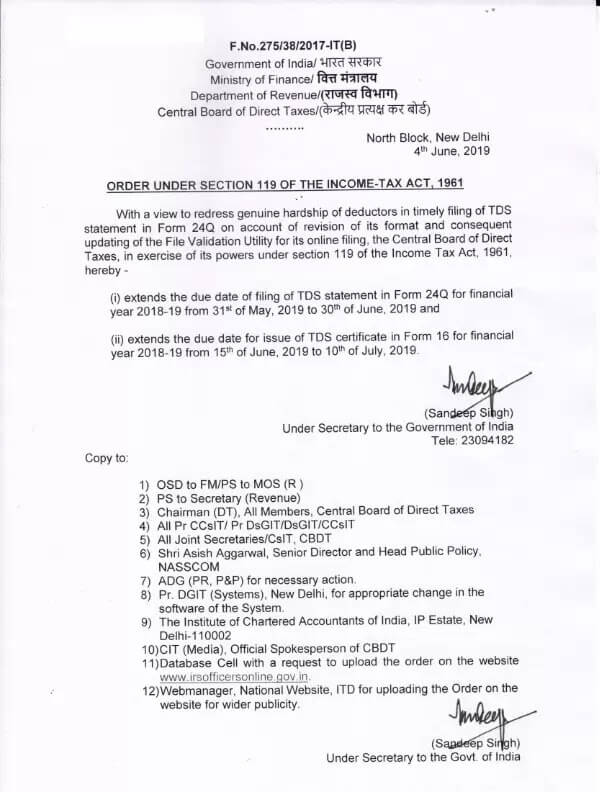

Last date of issue of Form 16 for FY 2018-19 extended upto 10th July, 2019

Last date of issue of Form 16 for FY 2018-19 extended upto 10th July, 2019

Extension of the due date of filing of TDS statement in Form 24Q [...]

Extension of due date of deposit of TDS, submission of quarterly statement of TDS and issue of Form 16 & 16A i.r.o. deductors of Odisha: CBDT Notification

Extension of due date of deposit of TDS, submission of quarterly statement of TDS and issue of Form 16 & 16A i.r.o. deductors of Odisha: CB [...]

Procedure, format and standards for issuance of TDS Certificate Form 16 Part B through TRACES: Income Tax Notification 09/2019

Procedure, format and standards for issuance of TDS Certificate Form 16 Part B through TRACES: Income Tax Notification 09/2019

F. No. Pr. DGIT(S) [...]

Income Tax Form No. 16 Part B and Form No. 24Q – Income Tax (3rd Amendment) Rules, 2019 – Notification

Income Tax Form No. 16 Part B and Form No. 24Q - Income Tax (3rd Amendment) Rules, 2019 - Notification

MINISTRY OF FINANCE

(Department of Revenu [...]

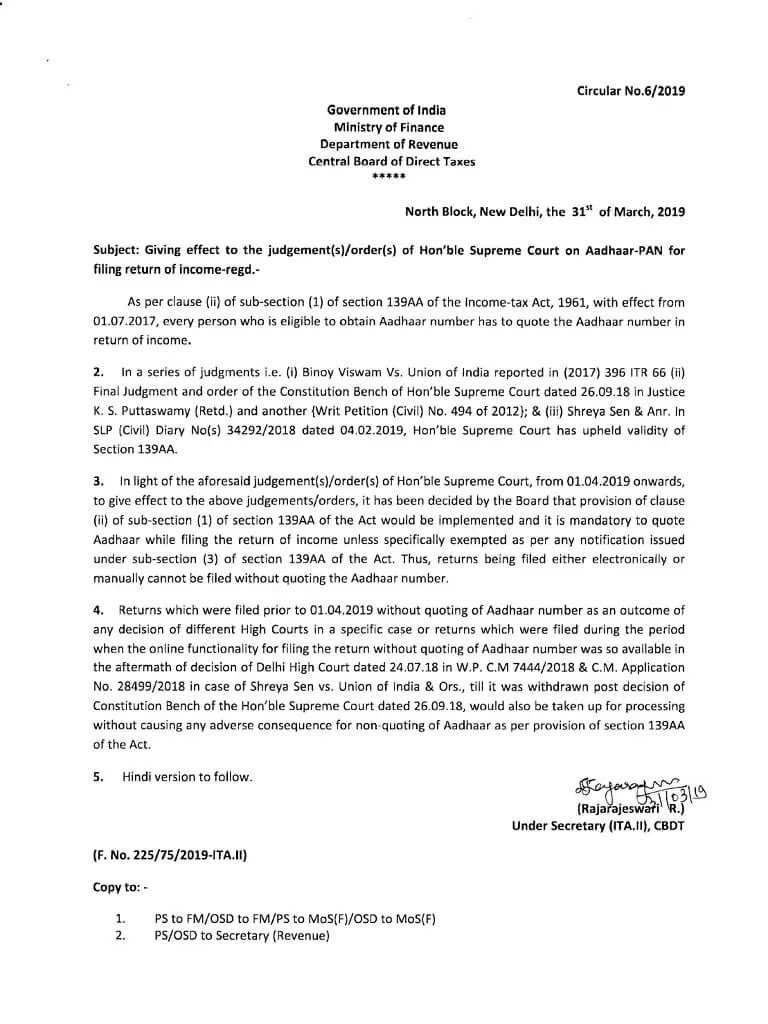

Mandatory to quote Aadhaar number while filing the Income Tax Return from 01.04.2019 onwards – CBDT Circular

Mandatory to quote Aadhaar number while filing the Income Tax Return from 01.04.2019 onwards - CBDT Circular

Circular No.6/2019

Government of In [...]

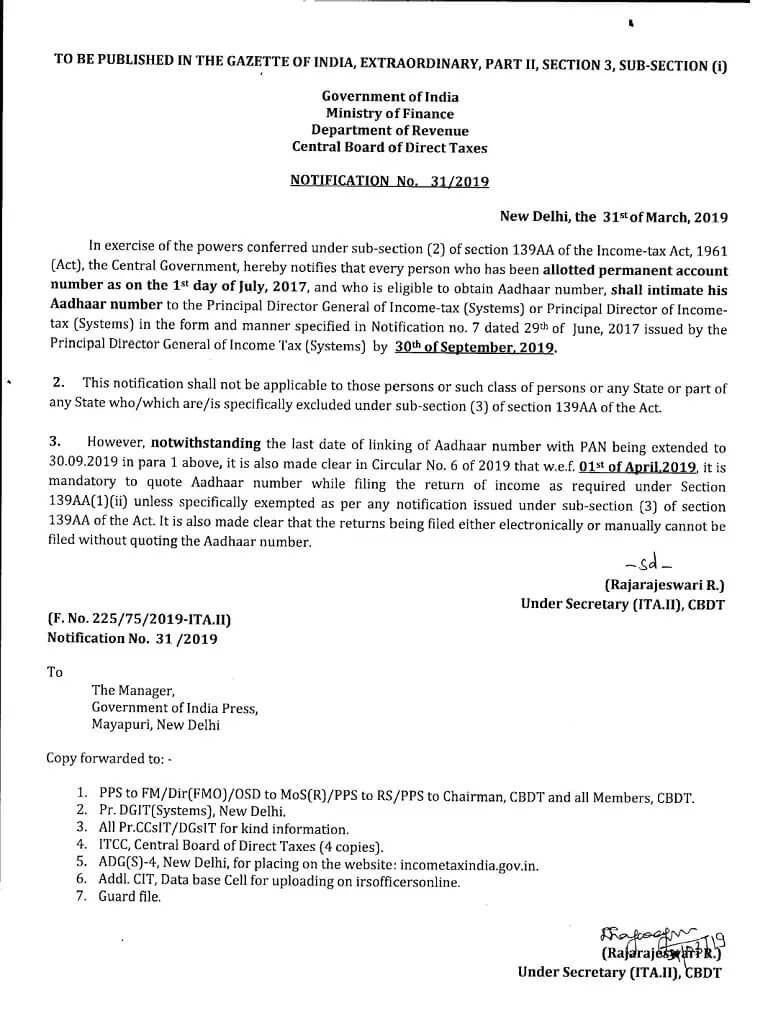

Aadhaar PAN linking: Last date extended up to 30th September 2019 – Mandatory to quote Aadhaar in filing of ITR

Aadhaar PAN linking: Last date extended up to 30th September 2019 - Mandatory to quote Aadhaar in filing of ITR

TO BE PUBLISH ED IN THE GAZETTE OF [...]

Gazzette Notification: Exemption u/s 10 of Income Tax – Rs. 20 Lakh for Gratuity w.e.f. 29.03.2018

Gazzette Notification: Exemption u/s 10 of Income Tax - Rs. 20 Lakh for Gratuity w.e.f. 29.03.2018

असाधारण

EXTRAORDINARY

भाग 1---खण्ड 3 [...]