Category: INCOME TAX

COVID-19 Outbreak: Finance Ministry issues Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020

COVID-19 Outbreak - Finance Ministry issues Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020 outlined Direct Taxes & Ben [...]

TDS guidelines on payments to BSNL VRS 2019 Optees – TDS on ex-gratia/Leave Encashment, Form 16, Tax Exemption etc.

Tax Deduction at Source (TDS) guidelines - TDS on ex-gratia, TDS on Leave Encashment, Form 16, Tax Exemption on payments to BSNL VRS 2019 Optees

[...]

Income Tax – FAQs on Salary Income – Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Income Tax - FAQs on Salary Income - Is standard deduction applicable to family pensioners from AY 2019-2020? and many more

Frequently Asked Quest [...]

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020 under Section 192 of the Income-Tax Act, [...]

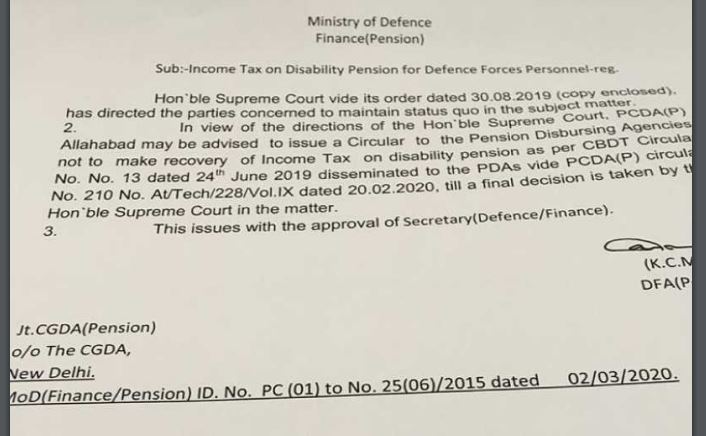

Income Tax on Disability Pension for Defence Forces Personnel – Status Quo by Hon’ble Supreme Court on the recovery reg – PCDA Circular No. 211

Income Tax on Disability Pension for Defence Forces Personnel - Status Quo by Hon'ble Supreme Court on the recovery reg - PCDA Circular No. 21 [...]

Exemption Free Income Tax Regime – Details छूट मुक्त आयकर प्रणाली – ब्यौरा

Exemption Free Income Tax Regime - Details छूट मुक्त आयकर प्रणाली - ब्यौरा

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

LOK SABHA

UNSTARRED

QUESTION N [...]

Income Tax Functionality available in Employee Login under EIS (PFMS)

Income Tax Functionality available in Employee Login under EIS (PFMS). Employee Information System (EIS) is a centralized, Integrated (with PFMS) Web [...]

PCDA (P) Circular No. 210 – Exemption from Income Tax – Service element and disability element of disability pension granted to disabled personnel of Armed Forces

PCDA (P) Circular No. 210 - Exemption from Income Tax - Service element and disability element of disability pension granted to disabled personnel of [...]

Rule 114AA – PAN – Aadhar Linking – Income-Tax (5th Amendment) Rules, 2020

Rule 114AA - PAN - Aadhar Linking - Income-Tax (5th Amendment) Rules, 2020

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT T [...]

केन्द्रीय बजट 2020-21: नई वैकल्पिक आयकर व्यवस्था Union Budget 2020-21: New Alternative Income Tax Regime

केन्द्रीय बजट 2020-21: नई वैकल्पिक आयकर व्यवस्था Union Budget 2020-21: New Alternative Income Tax Regime

2019 के अंतिरम बजट में हमारी सरकार ने [...]