Category: INCOME TAX

Income other than business or profession – Clarification on option u/s 115BAC of IT Act 1961: Circular C1 of 2020

Income other than business or profession - Clarification on option u/s 115BAC of IT Act 1961: Income Tax Circular C1 of 2020 dated 13.04.2020 issued b [...]

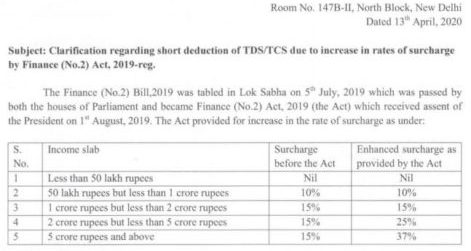

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

Submission of certificate for claiming deductions u/s 80G of the Income-tax Act, 1961 in respect of donation made by an employee to PM CARES FUND

Submission of certificate for claiming deductions u/s 80G of the Income-tax Act, 1961 in respect of donation made by an employee to PM CARES FUND

[...]

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS o [...]

IT Deptt to release all pending Income Tax Refunds upto Rs.5 Lakh immediately – Around 14 Lakh taxpayers to benefit

Income Tax Department to release all pending Income Tax Refunds upto Rs.5 Lakh immediately - Around 14 Lakh taxpayers to benefit

Press Information Bu [...]

Ready Reckoner – Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime i.r.o. Normal, Senior & Super Senior Citizen

Ready Reckoner - Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime calculated on Annual income starting from Rs.5 Lakh increas [...]

सीबीडीटी ने करदाताओं को टीडीएस/टीसीएस प्रावधानों के अनुपालन में हो रही कठिनाइयों को कम करने के लिए ऑर्डर जारी किया

सीबीडीटी ने करदाताओं को टीडीएस/टीसीएस प्रावधानों के अनुपालन में हो रही कठिनाइयों को कम करने के लिए ऑर्डर जारी किया CBDT issues orders u/s 119 of IT Ac [...]

COVID-19: Order u/s 119 of IT Act regarding submission of Form 15G and 15H for F.Y. 2020-21

COVID-19: Order u/s 119 of IT Act regarding submission of Form 15G and 15H for F.Y. 2020-21

F.No. 275/25/2020-IT(B)

Government of India/ भारत सरकार

[...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]