Category: INCOME TAX

PF tax ceiling will be applicable to GPF as well: CBDT chairman

PF tax ceiling will be applicable to GPF as well: CBDT chairman

Budget 2021-22 has rationalised tax-free income on provident fund contribution by hig [...]

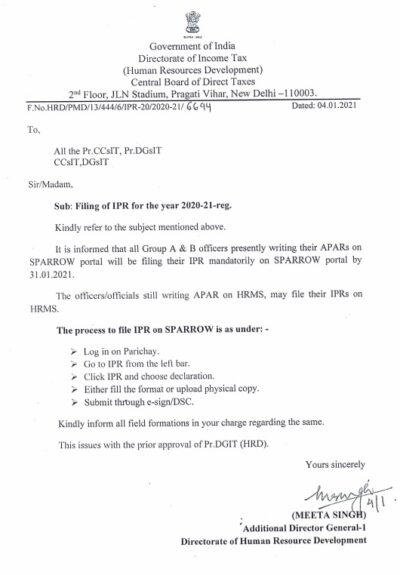

Filing of IPR for the year 2020-21: CBDT Order

Filing of IPR for the year 2020-21: CBDT Order

Government of India

Directorate of Income Tax

(Human Resources Development)

Central Board of Direct [...]

ITR filing date extended for these taxpayers- Income Tax Notification No. 93/2020

ITR filing date extended for these taxpayers- Income Tax Notification No. 93/2020

NOTIFICATION

New Delhi, the 31st December, 2020

S.O. 4805(E).—In [...]

Result of Departmental Examinations -2020 for ITOs and ITIs – Income Tax Department

Result of Departmental Examinations -2020 for ITOs and ITIs - Income Tax Department

Result of Departmental Examinations -2020 for ITOs

ITO Normal [...]

Aaykar Kutumb – An E-Diary functionality for Income Tax Officer and above : Instructions to download ‘Aaykar Kutumb’ Version 4.2

Aaykar Kutumb - An E-Diary functionality for Income Tax Officer and above : Instructions to download ‘Aaykar Kutumb’ Version 4.2

DIRECTORATE OF INCOM [...]

ITR – Income Tax Returns filing deadline extended from Dec 31 to January 10, 2021 for these taxpayers

ITR - Income Tax Returns filing deadline extended from Dec 31 to January 10, 2021 for these taxpayers

Press Information Bureau

Government of India [...]

CBDT amends jurisdiction of 67 Income tax Authorities vide Jurisdiction Order No. 3/2020

CBDT amends jurisdiction of 67 Income tax Authorities vide Jurisdiction Order No. 3/2020

Office of the Principal Chief Commissioner of Income Tax (In [...]

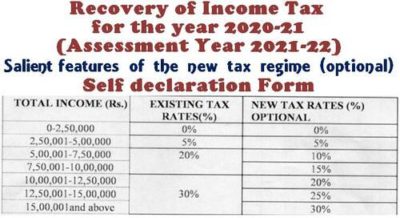

Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) – Salient features of the new tax regime (optional) – Self declaration Form

Recovery of Income Tax for the year 2020-21 (Assessment Year 2021-22) - Salient features of the new tax regime (optional) - Self declaration Form

Pri [...]

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – Income Tax Circular No. 20/2020

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 - CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisio [...]

Procedure to process of Medical Reimbursement Claim – Check List for Processing Medical Advance

Procedure to process of Medical Reimbursement Claim - Check List for Processing Medical Advance

By SPEED POST

F.No.D-12015/06/2020-Ad.IX

Government [...]