Category: INCOME TAX

Guidelines under Clause (10D) Section 10 of the IT Act – Exemption on the sum received under a life insurance policy: Circular No. 2 of 2022

Guidelines under Clause (10D) Section 10 of the IT Act - Exemption on the sum received under a life insurance policy

Circular No. 2 of 2022

F. No.37 [...]

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

ITR for Senior Citizens – To give a much-nee [...]

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22: Circular No. 01/2022

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22

On consideration of difficulties [...]

Income tax-returns e-filed for the Assessment Year 2020-21, pending for verification and processing: IT Circular No. 21/2021

Income tax-returns e-filed for the Assessment Year 2020-21, pending for verification and processing - One-time relaxation for verification : Circular [...]

National Pension Scheme Tier II- Tax Saver Scheme, 2020 (NPS – TTS): RBE No. 93/2021

National Pension Scheme Tier II- Tax Saver Scheme, 2020 (NPS – TTS) – Change in Operational Guidelines

RBE No. 93/2021.

GOVERNMENT OF INDIA (BHARAT [...]

e-Verification Scheme, 2021: Income Tax Notification No. 137/2021

e-Verification Scheme, 2021: Income Tax Notification No. 137/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTI [...]

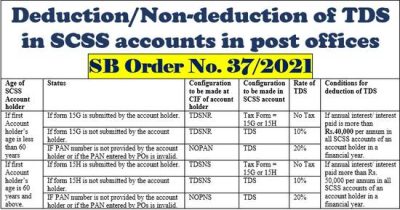

Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

SB Order No. 37/2021

F. No. FS-13/7/2020-FS

Government of Ind [...]

Income Tax e-Settlement Scheme, 2021: Notification No. 129/2021

Income Tax e-Settlement Scheme, 2021: Notification No. 129/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NO [...]

Submission of Income Tax Savings Documents for F.Y. 2021-2022, Format of Self Declaration and Rent Receipt: DAD

Submission of Income Tax Savings Documents for the Financial Year 2021-2022, Format of Self Declaration and Rent Receipt: DAD

GOVERNMENT OF INDIA

MI [...]

Income Tax Circular 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Income Tax Circular 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Directorate General Central Public Works D [...]