- 7th CPC Pre-2016 Pension Revision |Click to view|

- 7th CPC Post-2016 Pension Revision |Click to view|

- 7th CPC Defence Civilian Pre-2016 Pensioner |Click to view|

- 7th CPC Defence Civilian Post-2016 Pensioner |Click to view|

- 7th CPC Report |Click to view|

- Approval of 7th CPC |Click to view|

- 7th CPC Gazette Notification |Click to view|

- 7th CPC CCS(RP) Rules, 2016 |Click to view|

- Finance Ministry OM 7th CPC Pay Fixation |Click to view|

- Railway Service (Revised Pay) Rules, 2016 |Click to view|

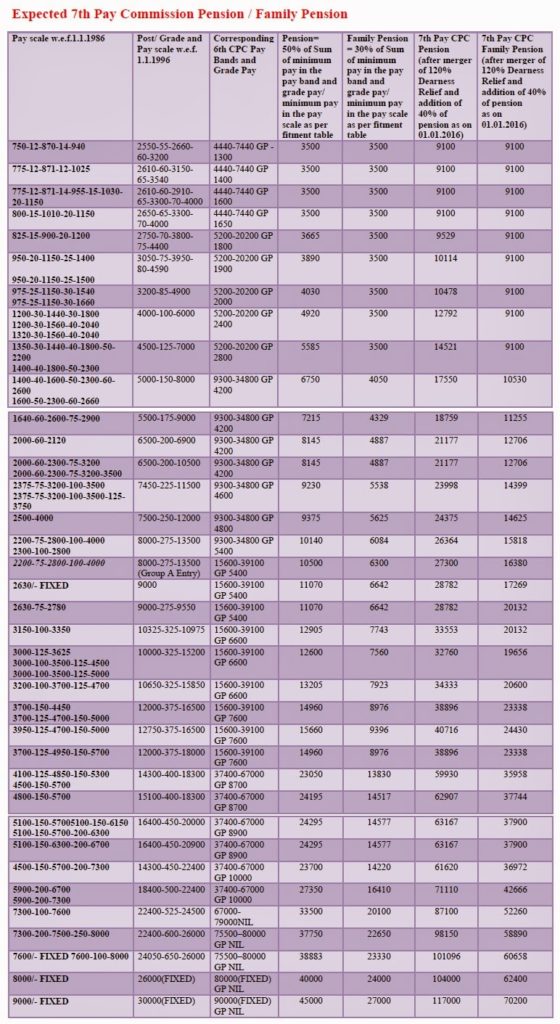

GConnect: Now, we have attempted to estimate 7th Pay Commission Pension for Central Government Pensioners and Railway Pensioners on the basis of 6th CPC Pension Fixation. Pensioners may please note that this is only an approximate estimation of pension based on the factors taken into account by Government while implementing 6th Pay Commission. So, if 7th Pay Commission adopts different set of principles for determining 7th Pay Commission pension then this estimation may not be correct. Also, due to non-availability of fitment table for 7th Pay Commission Pay revision as of now, 50% of minimum of 7th CPC pay band equivalent to pay scale in which pensioner retired which will be assured by every pay commission could not be calculated.

| Pay scale w.e.f.1.1.1986 | Post/ Grade and Pay scale w.e.f. 1.1.1996 | Corresponding 6th CPC Pay Bands and Grade Pay | Pension= 50% of Sum of minimum pay in the pay band and grade pay/ minimum pay in the pay scale as per fitment table |

Family Pension = 30% of Sum of minimum pay in the pay band and grade pay/ minimum pay in the pay scale as per fitment table |

7th Pay CPC Pension (after merger of 120% Dearness Relief andaddition of 40% of pension as on 01.01.2016) | 7th Pay CPC Family Pension (after merger of 120% Dearness Relief and addition of 40% of pension as on 01.01.2016) |

| 750-12-870-14-940 | 2550-55-2660-60-3200 | 4440-7440 GP -1300 | 3500 | 3500 | 9100 | 9100 |

| 775-12-871-12-1025 | 2610-60-3150-65-3540 | 4440-7440 GP 1400 | 3500 | 3500 | 9100 | 9100 |

| 775-12-871-14-955-15-1030-20-1150 | 2610-60-2910-65-3300-70-4000 | 4440-7440 GP 1600 |

3500 | 3500 | 9100 | 9100 |

| 800-15-1010-20-1150 | 2650-65-3300-70-4000 | 4440-7440 GP 1650 | 3500 | 3500 | 9100 | 9100 |

| 825-15-900-20-1200 | 2750-70-3800-75-4400 | 5200-20200 GP 1800 | 3665 | 3500 | 9529 | 9100 |

| 950-20-1150-25-1400 950-20-1150-25-1500 |

3050-75-3950-80-4590 | 5200-20200 GP 1900 |

3890 | 3500 | 10114 | 9100 |

| 975-25-1150-30-1540 975-25-1150-30-1660 |

3200-85-4900 | 5200-20200 GP 2000 |

4030 | 3500 | 10478 | 9100 |

| 1200-30-1440-30-1800 1200-30-1560-40-2040 1320-30-1560-40-2040 |

4000-100-6000 | 5200-20200 GP 2400 |

4920 | 3500 | 12792 | 9100 |

| 1350-30-1440-40-1800-50-2200 1400-40-1800-50-2300 |

4500-125-7000 | 5200-20200 GP 2800 |

5585 | 3500 | 14521 | 9100 |

| 1400-40-1600-50-2300-60-2600 1600-50-2300-60-2660 |

5000-150-8000 | 9300-34800 GP 4200 |

6750 | 4050 | 17550 | 10530 |

| 1640-60-2600-75-2900 | 5500-175-9000 | 9300-34800 GP 4200 | 7215 | 4329 | 18759 | 11255 |

| 2000-60-2120 | 6500-200-6900 | 9300-34800 GP 4200 | 8145 | 4887 | 21177 | 12706 |

| 2000-60-2300-75-3200 2000-60-2300-75-3200-3500 |

6500-200-10500 | 9300-34800 GP 4200 |

8145 | 4887 | 21177 | 12706 |

| 2375-75-3200-100-3500 2375-75-3200-100-3500-125-3750 |

7450-225-11500 | 9300-34800 GP 4600 |

9230 | 5538 | 23998 | 14399 |

| 2500-4000 | 7500-250-12000 | 9300-34800 GP 4800 | 9375 | 5625 | 24375 | 14625 |

| 2200-75-2800-100-4000 2300-100-2800 |

8000-275-13500 | 9300-34800 GP 5400 | 10140 | 6084 | 26364 | 15818 |

| 2200-75-2800-100-4000 | 8000-275-13500 (Group A Entry) | 15600-39100 GP 5400 | 10500 | 6300 | 27300 | 16380 |

| 2630/- FIXED | 9000 | 15600-39100 GP 5400 | 11070 | 6642 | 28782 | 17269 |

| 2630-75-2780 | 9000-275-9550 | 15600-39100 GP 5400 | 11070 | 6642 | 28782 | 20132 |

| 3150-100-3350 | 10325-325-10975 | 15600-39100 GP 6600 | 12905 | 7743 | 33553 | 20132 |

| 3000-125-3625 3000-100-3500-125-4500 3000-100-3500-125-5000 |

10000-325-15200 | 15600-39100 GP 6600 |

12600 | 7560 | 32760 | 19656 |

| 3200-100-3700-125-4700 | 10650-325-15850 | 15600-39100 GP 6600 | 13205 | 7923 | 34333 | 20600 |

| 3700-150-4450 3700-125-4700-150-5000 |

12000-375-16500 | 15600-39100 GP 7600 |

14960 | 8976 | 38896 | 23338 |

| 3950-125-4700-150-5000 | 12750-375-16500 | 15600-39100 GP 7600 | 15660 | 9396 | 40716 | 24430 |

| 3700-125-4950-150-5700 | 12000-375-18000 | 15600-39100 GP 7600 | 14960 | 8976 | 38896 | 23338 |

| 4100-125-4850-150-5300 4500-150-5700 |

14300-400-18300 | 37400-67000 GP 8700 |

23050 | 13830 | 59930 | 35958 |

| 4800-150-5700 | 15100-400-18300 | 37400-67000 GP 8700 | 24195 | 14517 | 62907 | 37744 |

| 5100-150-57005100-150-6150 5100-150-5700-200-6300 |

16400-450-20000 | 37400-67000 GP 8900 | 24295 | 14577 | 63167 | 37900 |

| 5100-150-6300-200-6700 | 16400-450-20900 | 37400-67000 GP 8900 | 24295 | 14577 | 63167 | 37900 |

| 4500-150-5700-200-7300 | 14300-450-22400 | 37400-67000 GP 10000 | 23700 | 14220 | 61620 | 36972 |

| 5900-200-6700 5900-200-7300 |

18400-500-22400 | 37400-67000 GP 10000 | 27350 | 16410 | 71110 | 42666 |

| 7300-100-7600 | 22400-525-24500 | 67000-79000NIL | 33500 | 20100 | 87100 | 52260 |

| 7300-200-7500-250-8000 | 22400-600-26000 | 75500–80000 GP NIL | 37750 | 22650 | 98150 | 58890 |

| 7600/- FIXED 7600-100-8000 | 24050-650-26000 | 75500–80000 GP NIL | 38883 | 23330 | 101096 | 60658 |

| 8000/- FIXED | 26000(FIXED) | 80000(FIXED) GP NIL | 40000 | 24000 | 104000 | 62400 |

| 9000/- FIXED | 30000(FIXED) | 90000(FIXED) GP NIL | 45000 | 27000 | 117000 | 70200 |

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Your father's upto the age of 67 years your mother will get full as enhanced Pension, as your father got the amount after that she will get 60% of pension as family pension until her life time.

Sir,

My pension was fixed in the Pay scale of Rs.5000-150-8000 at Rs.7943/- Retired in April,1999 in the Grade of Rs.5000-150-8000 as Head Clerk.In view of OM No38/37-08-P&PW(A) dated 28-01-2013, the corresponding pay scale/grade as per 6th CPC stands at Rs.9300-34800. Thus the pension has to be revised in this scale/grade accordingly. Kindly advise me for Caclulations of pension for 6th CPC and 7th CPC in details.

Thanks a lot,

PL Bindra

MOB 9418006810

Can any gov servant of group A,B on reaching 50/55 yrs age after fulfilling required criteria apply for VRS under FR 56(K) or are there are any specific reasons

Yes. if any Govt.servant under suspension or a charge sheet has been issued & the disciplinary proceedings are pending or if judicial proceedings on charges which may amount to gave misconduct are pending,are not allowed to avail VRS.

Pension of those retired prior to 1.1.2006 was consolidated as on 1.1.2006. Therefore, the question of refixing the pension of such pensioners as on 1.1.2016 does not arise. To arrive, the revised pension of such pensioners as on 1.1.2016, we need to multiply the pension fixed as on 1.1.2006 by the factor 2.57.

how much DA will be applicable with basic pension as given ur chart

I TOOK VRS on 25/04/2015 my last drawn PÀY was RS,23800,under SCALE of pay 9300-34800,grade PAY WAS RS ,4600/,I have put in 31 years of qualifying service, I am a Physically Handicapped Person what will be my basic PENSION please calculate and let me know.

I was working in Indian Railways I am a Physically challenged person.Lasr pay drawn Rs.22800 under PAY brand 9300-34800 . Grade pay Rs.4600. . I have put in 31 years of qualifying service.What will be my total PENSION.

Bijendra,

Respected,Sir

Arrears pre 2006 pensioners ,as per SC orders it is very high light for arrears to the ex men .but no arrears received till date Rank of JCOs . As per OROP scheme Subedar 28 years qualifying service of Y Gp 1st stall ment /arrear received RS -3020/-The 2 Nd stallment will get after 6 month. What is the meaning of 4 stallment of RS 1278/- for payment of OROP arrear.

Dear Sir. I AM A PHYSICALLY HANDICAPPED PERSON I WAS WORKING IN RAIL WHEEL FACTORY BANGALORE. I TOOK VRS DUE TO LEG PAIN . MY LAST DRAWN PAY WAS RS, 22800/-,UNDER SCALE PÀY 9300 – 34800… AVERAGE EMOLUMENT WAS FIXED AT RS,4560/-.COMMUTÀTÀTION AMOUNT IS RS 4560/- WHAT WILL BE MY PENSION IN 7TH PAY COMMISSION, I TOOK VRS ON 25/04/2015.

Hai sir this is ranjit here, as my dad passed away this month 5-12-2015, and he is a retired railway employee, he retired in 2011, as his age is 63 , can i know what will the percentage of pension will my mom get , and some one was telling that in 6th pay commission a rule was passed that till 10 years widow will get 100% of pension what my dad is drawing as on, is that true, can some reply me in this regds

I have given answer to you, please see below.

As the joint system of family is no more vogue in India. With the advent of nuclear families pensioners have to live alone sometime with their better halves and if wives died in old age pensioners have to live alone. Hence pensioners require more money to meet the expenses towards medical transport house rent etc. It would be more appropriate if some human consideration is adopted while recommending the 7th CPC recommendations for pensioners. Needless to mention that pensioners should also be granted 3% annual increments like regular Government servants.

Sir,

I retired on VRS with effect from 1983 May 2nd[FN]. I was UPSC elected government servant in the Andaman Nicobar services [Ministry of Home affairs under central]. I was posted at Government college, Port Blair. I suppose I am thus a retired class 1/ group A officer. My doubt is, am I entitled for OROP at par with the other 1 / A rank pensioners?

Secondly, the basic pay as on September 2015 is Rs- 7915 & allowances 8914 = total 17359.

May you kindly let me know what would be my pension after the revision granted by the 7th CPC?

I am running 76 [dob Dec 4th 1939], My e mail is [email protected]

Dear Sir,

I am unable to understand the working of pensioner hike format. Please help.

I am on family pension with drawings of approximate Rs.9500/- gross per month.

pension relates to ordinance factory. (central government). Can I know on approximate basis how to calculate the hike or what can be my drawings after the 7 CPC with some assumed hike percent.

Last basic pay in his pay scale at the time of Retirement equivalents basic pay of 7th CPC MATRIX LEVELS pay of 50% as Pension. Minimum of ₹ 9,000/- plus applicable dearness relief & in non-residents of CGHS areas or non-ECHS CARD for them with FIXED MEDICAL ALLOWANCE of ₹ 1000/-.

7 Cpc sarkar ki pure mansa public aur employ ke prati pesh karegi isliye iski gahrai se sameesha kare ek galat nirnay sarkar ko bgarpai karni padegi election me election najdeek a rahe for good gov

sarkari employ ko koi fayda diye bina 7 Cpc me dhokha dene ka kam ho raha hi jo kisi sarkar me ni kiya are jo purani rule hi ki pension 50% Mile reirement agae 62 ho gov kya neeti hi ye sab khatm kar ham public ko khush kar denge ni ye galat neeti sarkar ko duba degi itni mahgai hi aur is mahgai me yadi kisi ki naukri chali jay mane uski life khatm

Sir bjp gov ko employ ko pension 50% se badakar 60% Ho sarkar employ ke oppsite koi kam na kare sarkar ki yahi sab halat neeti ka rasult hi bihar election ye sochte hi ham sab kar denge koi kuch ni karega ye go ko ki galat think hi jo kisi gov ne ni kiya o aap karke pura virodh lena chahte hi

Maharashtra Govt. is anty employees,anty pensioners,anty senior citizens,anty jesth nagriks. F.M still not sanctioned 6% D.A. w.e.f. 1st January 2015 and w.e.f. 1st July 2015. Govt employees,pensioners are unhappy towards the attitude of style of function of F.M. is negative. now F.M. should either resigned immediately or have to be sanctioned immediately

I agree with the above two suggessions .Our Beloved PRIME MINISTER may kindly consider and arrange to issue suitable orders at the earliest.

R.Thandavakrishnan.

A good proportion of pensioners are into their seventies with ailments and infirmities relating to vital organs like the heart, kidney,liver and prostate. The traditional Indian joint family is declining, and the modern-day nuclear family is turning unkind to the aged. The aged are treated with contempt, and often left to their fate with no support system. Retired Government officials are eligible to get 20 per cent of additional pension when they complete 80 years of age. The 7 CPC should bring down the 80-year threshold to 75 years so that the septugenarians affected by impairment of normal physical or mental function can claim 20 per cent additional pension.

SCPC calculated pension as on 1-1-006 as under:

Basic pension on 31-12-2005 X 1.5 (50% merger of dearness relief) X 1.24 ( 1.74 minus 0.5 merged into basic pay) plus 0.4 of basic pay = BP ( 1.5) (1.24) +BP (0.4) = BP (1.86)

BP (0.4) = BP( 2.26)

Follow the same methodology, and we arrive at :

Let us assume that the Dearness Relief as on 1-1-2016 as 2.23 ( 2.13 on 1-1-2015 plus 10 points against two occasions on 1-7-2015 and 1-1-2016).

Assume that merger of 50 % of Basic Pension is must.

Then, the factor for consideration will be = 1.5 X 1.73 ( 2.23 minus 0.5)

Also, assume the same 40% adopted by the SCPC as benifit.

Then, the formula would be : BP X (1.5 x 1.73) + BP ( 0.4) = BP ( 2.595) + BP ( 0.4) = BP (2.995)

A pensioner drawing a pension of 15660 ( PB 15600–39000 plus GP 7600) should get Pension equal to 15660 X 2.995 = 46,901.7 ( rounded to 46,902), and not 40,716.

This is a rational view, based on the assumptions which the 6th CPC took for granted.

It is injustice to the retired government employees. Cleverly, the commission has brought down the percentage of pension to the pre-2016 retirees. Earlier, it was clear 50% of the pay. Now, it has been reduced to almost 45% of the pay.

The pension should be clear 50% of the corresponding salary irrespective of the date of retirement. The older generation should not be looked down upon as has been done.

The pension should also get increased 3% every year like the serving employee. Prey the commission to take a fresh look of the whole issue again.

Old retirees need more money for their daily routine as well as treatment. The cost of treatment is sky-rocking . Now a days, no body is willing to look after the older peoples. So they have to shed extra money to accomplish their daily survival. The 7 th CPC should look into this aspect, our country is not welfare state. In-spite of a curtail in pension, may consider to maintain status-quo if it is not feasible to increase.