Amendment in Section 192A of the IT Act, 1961 – Instructions for deduction of TDS on withdrawal from PF

For Web Circulation

Employees’ Provident Fund Organisation

(Ministry of Labour & Employment, Govt. of India)

Bhavishya Nidhi Bhawan, 14-Bhikaji Cama Place, New Delhi-110066

No. WSU/6(1)2011/IT/Vol- IV

Date: 21 MAY 2015

All Add. CPFC (Zones)

All RPFC/OIC of

ROs/SROs.

Sub: Amendment in Section 192A of the IT Act, 1961 – Instructions for deduction of TDS on withdrawal from PF.

Ref: Head Office circular of even number dated 18.03.2015.

Sir/Madam.

The Finance Act, 2015 (20 of 2015) has inserted a new section 192A regarding the payment of accumulated provident fund balance due to an employee. The provision shall take effect from 1st June, 2015. A copy of the said provision is enclosed for information.

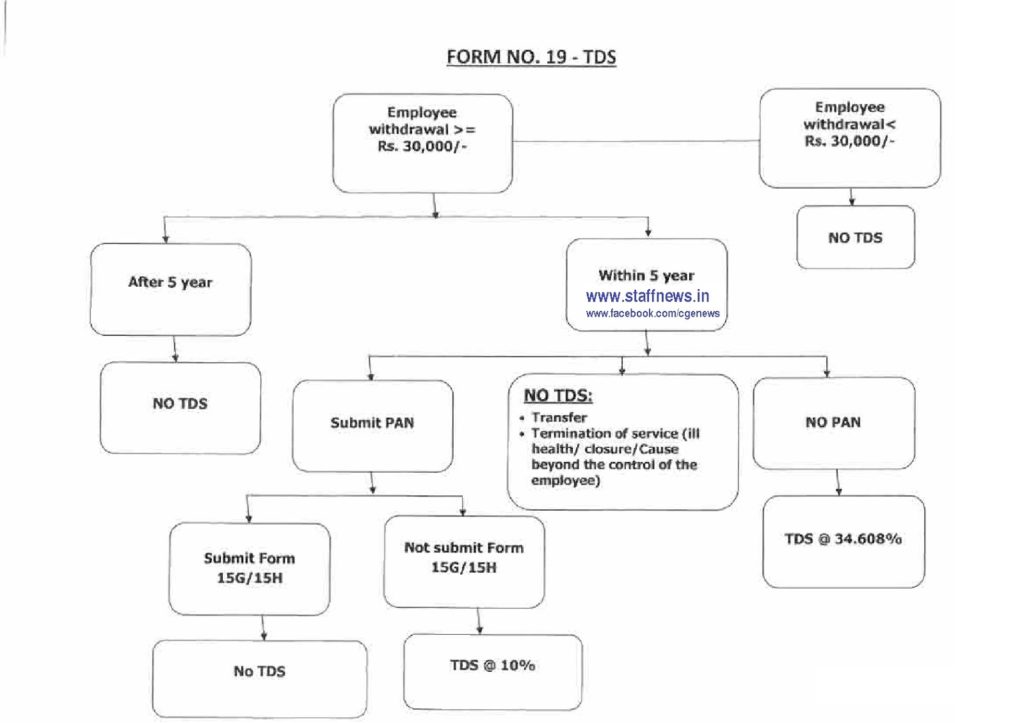

2. Income Tax shall be deducted at source (TDS) at the following rates if at the time of payment of the accumulated PF balance is more than or equal to Rs.30,000/-, with service less than 5 years:-

a) TDS will be deducted @ 10% provided PAN is submitted. In case Form No. 15G or 15H is submitted by the member, then no TDS shall be deducted.

b) TDS will be deducted @ maximum marginal rate (i.e. 34.608%) if a member fails to submit PAN (and no Form No. 15G or 15H)

3. TDS shall not be deducted in respect of the following cases:-

- Transfer of PF from one account to another PF account.

- Termination of service due to ill health of member, discontinuation/contraction of business by employer, completion of project or other cause beyond the control of the member.

- If employee withdraws PF after a period of five years of continuous service, including service with former employer.

- If PF payment is less than Rs. 30,000/- but the member has rendered service of less than 5 years.

- If employee withdraws amount more than or equal to Rs.30,000/-, with service less than 5 years but submits Form 15G/15H along with their PAN

A flow-chart is appended for understanding the implications of the amended provisions in the Income Tax Act, 1961.

4. Kindly take note that TDS is deductible at the time of payment of provident fund in Form No. 19. Form No. 15H is for senior citizens (60 years & above) while Form No. 15G is for individuals having no taxable income. Form 15G & 15H are self-declarations and may be accepted as such in duplicate. Form 15G & 15H may not be accepted if amount of withdrawal is more than 2,50,000/- and Rs.3,00,000/- respectively. Members shall quote PAN in Form No.15G/15H and in Form No. 19. The field offices may purchase pre-printed Form No. 15G & 15H to assist the members in filling up Form No. 19.

5. The process for authorization of Form No. 19 shall be as per the existing system. However, wherever TDS has to be deducted @10%, the same may be approved on Form No. 19 by the APFC (Accounts). Wherever the TDS has to be deducted @34.608%, the same may be approved on Form No. 19 by a RPFC level officer. These instructions shall apply in initial stages of implementation of the amended income tax provisions. Since the members may not be aware of the new provision, therefore, it shall be the responsibility of SSA (Accounts) to communicate the same to the member on telephone and record the same in Form No. 19 to submit PAN, Form No. 15G/15H, if applicable. A system generated statement of Tax Deducted at Source (TDS) may invariably be sent to the member.

6. Members who have rendered continuous service of 5 years or more, including service with former employer, shall not be required to submit PAN and Form No. 15G/15H along with Form No. 19. Similarly, members whose service has been terminated due to his ill health, contraction or discontinuance of business of employer or other cause beyond the control of the member shall not be required to submit PAN, Form No. 15G/15H alongwith Form No. 19. In such cases no income TAX (TDS) shall be deducted in terms of Rule 8 of Fourth Schedule to the Income Tax Act, 1961.

7. The field offices shall deposit the Tax Deducted at Source (TDS) and returns thereof by 7th of the following month. The existing TAN number obtained the respective offices may be used to deposit tax to the local income tax authority. The in-house responsibility for deposit of tax and returns thereof shall lie with Drawing & Disbursing Officer (DDO) as per the existing system. The concerned officers and staff may be given an in-house training for implementation of new provisions of RPFCs may engage CAs, who are on our panel.

8. The above should be made applicable with effect from 01.06.2015 and all steps should be taken before hand such as procuring copies of Form 15G and 15H. In case of any clarification, the same may be escalated to the Head Office.

Yours faithfully,

Encl: As above.

(Sanjay Kumar)

FA&CAO

Click here to view full Order

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS