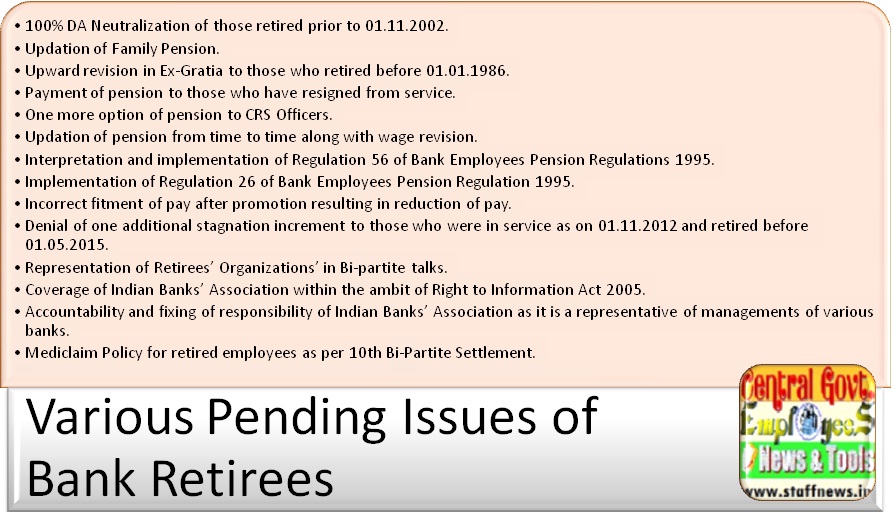

Various Pending Issues of Bank Retirees – Forum of Retired Bank Employees writes to MoS(Finance):-

1.) 100% DA Neutralization of those retired prior to 01.11.2002.

2) Updation of Family Pension.

3) Upward revision in Ex-Gratia to those who retired before 01.01.1986.

4) Payment of pension to those who have resigned from service.

5) One more option of pension to CRS Officers.

6) Updation of pension from time to time along with wage revision.

7) Interpretation and implementation of Regulation 56 of Bank Employees Pension Regulations 1995.

8) Implementation of Regulation 26 of Bank Employees Pension Regulation 1995.

9) Incorrect fitment of pay after promotion resulting in reduction of pay.

10) Denial of one additional stagnation increment to those who were in service as on 01.11.2012 and retired before 01.05.2015.

11) Representation of Retirees’ Organizations’ in Bi-partite talks.

12) Coverage of Indian Banks’ Association within the ambit of Right to Information Act 2005.

13) Accountability and fixing of responsibility of Indian Banks’ Association as it is a representative of managements of various banks.

14) Mediclaim Policy for retired employees as per 10th Bi-Partite Settlement.

FORUM OF RETIRED BANK EMPLOYEES

C/0 National Institute for Banking Education and Research

K — 5, Induprabha Society, 490, Narayan Pewth Pune 411 030

E mail: niberpune©yahoo.com, Phone: 020 24458228

(Registered under the Societies Registration Act 1860 under No. 6911/91 on 21-1-93 and under Bombay Public. Trust Act 1950 under No. F8005/1993 on 25-2-93)

No. FORBE/MSF/325/2015-16

19.01.2016

Shri.Jayant Sinhaji,

Hon. Minister of State (Finance),

Government of India,

North Blocks,

New Delhi 110 001.

Respected Sir,

Sub:Various Pending Issues of Bank Retirees .

We are thankful to you for having spared your valuable time for granting us an audience and for giving patient hearing to the pending issues of the bank retirees. We have to submit the following for favour of your kind consideration.

1.) 100% DA Neutralization of those retired prior to 01.11.2002.

During the course of discussions on 8th Bi-Partite settlement a separate agreement was entered into by Indian Banks’ Association with award staff unions and officers’ organizations regarding pension issues. The basic pension for those who retired from 01.04.1998 to 31.10.2002 covered under 7th Bi-Partite Settlement and from 01.11.2002 to 30.04.2005 covered under 8th Bi-Partite Settlement has been fixed at 50% of average of last 10 months basic pay of their retirement instead of notional basic pay (i.e. basic pay as per 6th Bi-Partite settlement plus DA at 1616 basis points) that was considered after 01.04.1998. Also the dearness allowance is paid with 100% neutralization to those retirees who have retired after 01.11.2002. This was done effective from 01.05.2005. This has resulted in creating two classes of pensioners one retired before 01.11.2002 and the other retired after 1.11.2002. D.A. being paid on tapering basis to Retirees prior to 01.11.2002 are suffering huge monetary loss for the last 15 years (as other class is getting 100% D.A. Neutralization w.e.f. 01.05.2005) Clerical staff Rs.500 to Rs.1300 and Officers staff Rs.2000 to 8000 per month.

Therefore 100% neutralization of dearness relief needs to be paid to all retirees with effect from 01.05.2005 irrespective of their date of retirement.

2) Updation of Family Pension.

The enhanced family pension is paid for a period of 7 years from the date of death of the employee up to completion of 65 years of age of the deceased employee at 30% of last pay and the normal family pension is being paid at 15% of last pay drawn. There is a long pending demand for improvement in the family pension and the family pension should now be paid at 30% for the life time.

3) Upward revision in Ex-Gratia to those who retired before 01.01.1986.

The retirees and spouses of deceased retirees who retired prior to 01.01.1986 are being paid Ex-Gratia at the rate of Rs.350/- and Rs.175/- p.m. plus dearness relief thereon. The total amount of Ex-Gratia paid to pre-1986 retiree is Rs.3458/- and for spouse it is Rs.1729/- for January 2016. This amount is very meager during present days and needs to be upwardly revised so that it will give some relief to these ageing super senior citizens. We may mention some of the banks are paying some amount in addition to above as a welfare measure. There should be upward revision and uniformity in the matter of payment of Ex-Gratia amount.

4) Payment of pension to those who have resigned from service.

The IBA has excluded category of the employees who have resigned from the service for the purpose of payment of pension under pension regulations 1995, even though the employees have voluntarily left the services after giving requisite notice on completion of minimum qualifying service for payment of pension and after its acceptance and then relieving the employees from services. Such mode of exit is in fact covered as voluntary retirement from the service.

Similarly the employees who were in the service as on the date of settlement i.e. on 27.04.2010 and had resigned from their posts after that date but before the date of issue of circular by the respective banks (after 10.08.2010) are also denied to join the pension scheme for any logical reason.

Some 22 officers from Vijaya Bank who had resigned got relief from Karnataka High Court and they got their second option of pension only after the SLP filed by the Bank was dismissed by Supreme Court. However this decision of Karnataka High Court is not extended to other bank’s retired employees who sought retirement by tendering resignation letters. The most interesting part in this case is that even other employees and officers of Vijaya Bank who had resigned are also not extended the second option of pension thereby creating artificial classes in retirees.

Very recently Asger Ibrahim Amin Vs LIC Civil Appeal No. 10251 of 2015 held that” It seems obvious to us that the appellants case does not fall within the postulation of Rule 23 as the last four categories or genres or types of cessation of services are in character punitive; and the first envisages those resignations where the right of pension has not been earned by that time or where it is without the permission of the corporation”

This interpretation of SC is exactly in tune with the Regulation 10 of BEPR 1993, which was recorded as intention of the parties to the settlement. Hence IBA may please be advised to adopt the interpretation of Regulation 22 of BEPR as interpreted by SC, which will lead NOT ONLY justice to employees besides withdrawing of 500+ legal cases before the judiciary. The number of left over resigned employees will be about 3500 in the banking industry as a whole. (This will be less than 1% of the total retired employees.)

5) One more option of pension to CRS Officers.

Indian Banks’ Association has issued a circular on 30.06.2015 advising all the banks to extend one more option of pension to those award staff employees who are compulsorily retired where as the similarly placed officer employees are not given the second option for pension. When both the award staff and officer employees are covered under the uniform pension regulations covering only award staff for pension has led to discrimination. The IBA has mis-interpreted the provision of Regulation 22 of BEPR since beginning that lead to legal battle and very few employee could afford to fight and got the relief but IBA did not apply SC order universally to all the Banks. In a recent Judgement, of SC in BOB Vs S K Kool commented on the settlement and allowed pension to CRS employees but again IBA restricted its benefit to to award staff employees despite SC gave pension to CRS officers in the matter of Andhra Bank.

6) Updation of pension from time to time along with wage revision.

Updation of pension is one more grave area for bank retirees. The senior level executives retired during the period of earlier settlements after 01.1.1986, are getting much less pension than the junior level officers, award staff retired during the period of 8th and 9th settlements. The General Manager retired in 1995 is getting lesser pension than Scale III officer retired in 2005 or 2008. The same applies in case of Scale III officer retired in 1995 and the Clerk retired in 2005 or 2008.

Quite often this issue is related to the cost burden by various authorities and legitimate demand of retired bank employees is being denied. In fact the pension funds of all banks are adequate and strong enough to take care of the financial liability and the Government as well as the banks will-not be required to contribute anything towards the incremental liability.

7) Interpretation and implementation of Regulation 56 of Bank Employees Pension Regulations 1995.

The Bank Employees Pension Regulations 1995 are silent over certain issues pertaining to treatment to additional commuted basic pension after wage revision, necessity of medical examination in case of fresh pension option (2nd pension option in 2010) leading to injustice, unrest amongst the retirees. Regulation 56 states that “Regard may be had to the corresponding provisions of Central Civil Services Rules, 1972 and Central Civil Services (Commutation of Pension) Rules 1981.” However Indian Banks’ Association is unwilling to implement this provision of Regulation 56. This may lead unwarranted legal battle.

8) Implementation of Regulation 26 of Bank Employees Pension Regulation 1995.

Despite the decisions of various high courts the Regulation 26 of Bank Employees Pension Regulations 1995 is not implemented and the concerned affected officers are fighting their cases in the courts. This Regulation needs to be implemented uniformly without any more delay. Even after 20 years of adoption of Pension Regulations 1995, the Indian Banks’ Association and individual banks could not finalize the upper limit of recruitment age for officers.

9) Incorrect fitment of pay after promotion resulting in reduction of pay.

It is observed that clerks / special assistants at last stages in the scale, who are granted 5th, 6th, 7th stagnation increment, are getting lesser salary after promotion to officers cadre than what they were getting as clerks / special assistants due to incorrect fitments. The PQP is also ignored at the time of fitments in officer’s cadre. To compensate this shortfall after promotion banks are paying personal allowance that is not considered as pay for the purpose of superannuation benefits. Thus the promotion turns in to punishment in such cases. Bank of Maharashtra has written to IBA on this issue in January 2015 with reminders in March 2015, July 2015, and November 2015. IBA has not responded till date. This will lead to unwarranted litigations.

10) Denial of one additional stagnation increment to those who were in service as on 01.11.2012 and retired before 01.05.2015.

In the 10th Bi-Partite Settlement / Joint Note for wage revision, award staff and officers in Scale II, III, and IV are made eligible for one more stagnation increment with effect from 1st May 2015. This has resulted in making those award staff members and officers in Scale II, III, and IV, ineligible to draw this additional increment, who were in the service of banks as on 01.11.2012 and retired thereafter but on or before 30.04.2015. This has happened for the first time in the history of wage revision of bank employees as in the entire in past wage revisions and stagnation increments were (made eligible to draw) paid from the date of effect of the agreement. Thus all the staff members who were in the service of the bank as on the date of effect and retired thereafter before the date of signature of the agreement could not get the benefits of such additional stagnation increments incurring monetary loss for 30 months.

11) Representation of Retirees’ Organizations’ in Bi-partite talks.

It is a long pending demand of the retirees’ organizations to allow them representation in the negotiating committee / wage revision talks. Even the Government of India has also advised IBA in the past to hold discussions with the retirees’ organizations. However IBA has neglected this vital aspect. The stand taken by IBA that there is no contractual relationship with the retired employees is strange on this background as the pension is being paid as per pension regulations that have a statutory force. The retired employees and their organizations only will be in a position to present their grievances appropriately and anomalies such as mentioned at point No.7.8.9 & 10 could have been avoided.

12) Coverage of Indian Banks’ Association within the ambit of Right to Information Act 2005.

Indian Banks’ Association is not brought under the purview of Right to Information Act 2005. All the Public Sector Banks are members of IBA and they contribute towards the expenses IBA is required to incur on various heads. IBA also signs wage agreements with the award staff and officers unions / associations periodically and mediate between the Government of India and PSBs. It also issues directives and guidelines to PSBs and the staff is governed by these directives and guidelines. The P885 cover more than 80% of staff in banking industry and IBA has carved out most of its functional staff from these PSBs.

In most of the legal cases the PSBs are fighting in various High Courts and Supreme Court regarding service conditions, wage and pension agreement. IBA is one of the respondents along with the banks. It is learnt that in 2010 IBA has advised all the PSBs that it will fight all the cases in connection with 2nd option of pension and individual banks should not give separate advocates to appear in the cases. The advocates appointed by IBA normally represent both the IBA and the individual bank. It is also a common practice that unless IBA clears a specific directive banks are not implementing it despite High Court, Supreme Court Decisions. This is against the Litigation Policy. Approaching the Apex Court against the High Court decisions is nothing but delaying tactics at the instance of IBA.

Whenever any query is asked to individual banks, government authorities they either point out fingers at IBA or refer the matter to IBA but IBA itself is not answerable. IBA, therefore should be brought under the purview of RTI Act 2005 to make it answerable to the queries.

13) Accountability and fixing of responsibility of Indian Banks’ Association as it is a representative of managements of various banks.

After the introduction of Bank Employees Pension Regulations 1995, a number of cases are filed in various High Courts and Supreme Court for redressal of the injustice, interpretation of regulations. The banks are acting on the advice of IBA but IBA is not responsible or answerable to anybody. Due to the IBA guided actions by banks unrest prevails in staff members and they are required to go in legal actions. It is also observed that IBA is not responding even to references by banks for over one year and individual bank managements are shying to take decisions in the absence of guidance from IBA. The authorities at every level in banks are considered responsible and answerable for not responding where as the authorities at IBA are not responsible and answerable for any of their advice to the banks. IBA therefore needs to be brought under ambit of RTI Act, 2005 to make it and authorities responsible and answerable.

14) Mediclaim Policy for retired employees as per 10th Bi-Partite Settlement.

IBA has ‘purchased mediclaim policy for retired employees’ of all banks’ effective from 01.11.2015 from United India Insurance Company the lead insurers. After acceptance of the premium the insurance company has now clarified that it will not extend the cover for domiciliary treatment, critical illness, and corporate buffer of Rs. 100 crores and excluded the dependent parents and children from the cover contradictory to the scheme. After purchasing this policy by IBA, many member banks have withdrawn, reduced or altered the terms of medical reimbursement schemes operated through the Staff Welfare Funds. Such actions of insurance company and member banks have caused multiple injustice to the retired employees who in fact needs immediate and adequate reimbursement of medical expenses.

We therefore request you to intervene and advise all the concerned authorities to redress the grievances of the retired staff members of banking industry. We request you to issue necessary instructions to the IBA to hold negotiations / discussions with the representatives of FORUM and to resolve all issues of retired employees who have toiled hard during their hay days for the progress and growth of the banking industry.

We once again thank you for a patient hearing.

Yours faithfully,

sd/-

President.

Signed Copy click here

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

what about the issue raised for compassionate appointment prior to 05.08.2014. will they b ignored ???? if so then great success by aibea or nobw coz for which the issues arised they r to b ignored

Till a time all the NPAs are realised the bank employees pay and perks must be stopped.