Innovative approach: Government staff’s pay hikes may fund bank capitalisation

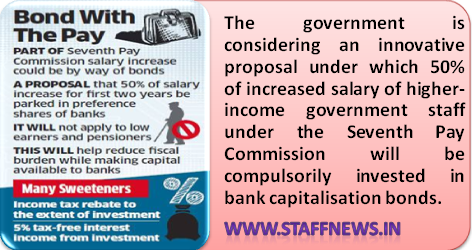

NEW DELHI: The government is considering an innovative proposal under which 50% of increased salary of higher-income government staff under the Seventh Pay Commission will be compulsorily invested in bank capitalisation bonds. The proceeds will be used to recapitalise banks without additional pressure on the fisc.

While

this will result in less cash in the hands of higher-income employees,

as a sweetener they will get income tax rebate on the amount invested.

Those wanting to invest more than 50% to save tax will be allowed to do

so. The Bank Recapitalisation Scheme, as this proposal is being called,

will be voluntary for employees with lower salaries (those in the Rs

5,200-20,200 bracket) and pensioners.

this will result in less cash in the hands of higher-income employees,

as a sweetener they will get income tax rebate on the amount invested.

Those wanting to invest more than 50% to save tax will be allowed to do

so. The Bank Recapitalisation Scheme, as this proposal is being called,

will be voluntary for employees with lower salaries (those in the Rs

5,200-20,200 bracket) and pensioners.

While this will result in less cash in the hands of higher-income employees, as a sweetener they will get income tax rebate on the amount invested. Those wanting to invest more than 50% to save tax will be allowed to do so. The Bank Recapitalisation Scheme, as this proposal is being called, will be voluntary for employees with lower salaries (those in the Rs 5,200-20,200 bracket) and pensioners.

A finance ministry official confirmed that preliminary discussions around this proposal were held at a meeting on Thursday, but no decision on its implementation was taken. “The issue was discussed. We are looking at all options,” he said.

“The proposal entails that through a provision under Income Tax Act, tax rebate should be offered to all employees receiving extra salary income through pay commission in the year 2016-17 and 2017-18, provided the money is invested in this Bank Recapitalisation Scheme,” added the official.

The government will have to additionally shell out Rs 40,000-50,000 crore annually on account of implementation of the seventh pay commission recommendations with effect from January 1, 2016. If this proposal is accepted, a portion of this money will be used to capitalise banks. According to finance ministry estimates, state-run banks will require Rs 1.8 lakh crore of additional capital in the next four financial years, of which Rs 70,000 crore will be provided by the government.

The government has budgeted Rs 25,000 crore for bank capitalisation in the current fiscal. While the government has said it has made adequate provision in the Budget to cover the extra spending on account of the pay commission recommendations, analysts reckon it is not adequate and full implementation of award will make it difficult to achieve the fiscal deficit target of 3.5% of GDP.

“Increase in government employee wages and pension expenditure on account of seventh pay commission recommendations is not fully provided for in the Budget,” Morgan Stanley had said in a report.

The proposal currently under consideration gives the government the leeway to meet both its pay commission and bank capitalisation commitments without putting the fiscal deficit target under threat. Bonds will provide the exchequer some wriggle room. The payment will become due when bonds mature ..

The flip side is that the proposed scheme could annoy government employees expecting a greater take-home pay. Hence the scheme has a tax exemption lollipop.

A second government official said this amount will be used to recapitalise banks through a special bank capitalisation fund that will invest in perpetual non-redeemable preference shares issued by banks. Banks will pay 5.1% dividend that is also proposed to be exempted from the dividend distribution tax. The fund will in turn pay 5% interest to government employees, retaining 0.1% as administrative charge.

“This interest income will also be tax free for government employees,” he said, which will increase the effective yield. The government will eventually pay back the amount in four equal investments after 8, 9, 10 and 11years, spreading the fiscal burden of repayment over that period. It will guarantee payment of 5% interest and repayment of deposits irrespective of whether the banks pay the dividend or not, the official added.

Read more at:

Economic Times

While this will result in less cash in the hands of higher-income

employees, as a sweetener they will get income tax rebate on the amount

invested. Those wanting to invest more than 50% to save tax will be

allowed to do so. The Bank Recapitalisation Scheme, as this proposal is

being called, will be voluntary for employees with lower salaries (those

in the Rs 5,200-20,200 bracket) and pensioners.

employees, as a sweetener they will get income tax rebate on the amount

invested. Those wanting to invest more than 50% to save tax will be

allowed to do so. The Bank Recapitalisation Scheme, as this proposal is

being called, will be voluntary for employees with lower salaries (those

in the Rs 5,200-20,200 bracket) and pensioners.

NEW

DELHI: The government is considering an innovative proposal under which

50% of increased salary of higher-income government staff under the

Seventh Pay Commission will be compulsorily invested in bank

capitalisation bonds. The proceeds will be used to recapitalise banks

without additional pressure on the fisc.

DELHI: The government is considering an innovative proposal under which

50% of increased salary of higher-income government staff under the

Seventh Pay Commission will be compulsorily invested in bank

capitalisation bonds. The proceeds will be used to recapitalise banks

without additional pressure on the fisc.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Long term Fixed deposit 5 years with reasonable attractive interest rate which can can be claimed under section 80 C may be floated so that bank will get deposits and govt will have funds and excess cash in the public hands will be minimised is best action. But what the govt is thinking we Donot know. They like to charge Service tax,Swachabharath Tax on the interst component also.Then who will deposit in banks.Now the govt is of the openion how to attract Zero interst/-ve rate of interest also as in some other countries.