Report of Seventh Central Pay Commission

Chapter 8.7 Allowances

related

to

Housing

Allowances

Covered

>

8.7.1 Alphabetical list of Allowances covered here is as under:

- Compensation in Lieu of Quarters (CILQ)

- Family Accommodation Allowance

- Family HRA Allowance

- House Rent Allowance (HRA)

- Hutting Allowance

- Rent Free Accommodation

- Single in Lieu of Quarters (SNLQ)

Introduction

8.7.2 Provision of affordable and comfortable housing is a source of concern for most Central Government employees. It needs to be addressed in the

changing social scenario where nuclear families are on the rise, more women are joining the work force and there is growing urbanization. The various

components involved are examined below in detail.

changing social scenario where nuclear families are on the rise, more women are joining the work force and there is growing urbanization. The various

components involved are examined below in detail.

House

Rent

Allowance

(HRA)

8.7.3 Presently, HRA is payable at the following rates:

|

Population of

Cities/Towns |

Class of

Cities/Towns |

HRA rates as % of Basic Pay

(including MSP and NPA) |

| 50 lakh and above | X | 30 |

| 50–5 lakh | Y | 20 |

| Below 5 lakh | Z | 10 |

8.7.4 There are a large number of demands for paying HRA as a percentage of (Basic Pay + DA), instead of as a percentage of Basic Pay alone, as at present.

Representations have also been received regarding enhancement of percentage rates and having only two classifications of Metros and Non-metros (instead of

the present classification of X, Y and Z cities).

Representations have also been received regarding enhancement of percentage rates and having only two classifications of Metros and Non-metros (instead of

the present classification of X, Y and Z cities).

8.7.5 PBORs of uniformed forces have vehemently argued for doing away with the concept of Authorized Married Establishment and the requirement of a minimum

age of 25 years for grant of Compensation in Lieu of Quarters (CILQ).

age of 25 years for grant of Compensation in Lieu of Quarters (CILQ).

Analysis

and

Recommendations:

and

Recommendations:

8.7.6 Compensation towards the housing needs of Central Government employees is covered in three ways:

- As a component of Basic Pay when it is initially fixed (based upon the Aykroyd formula)

- As a constituent of Dearness Allowance [the AICPI(IW), on which the DA is currently based includes a weight of 15.27% towards housing], and

- In the form of House Rent Allowance

8.7.7 In view of the fact that the DA calculation methodology that is being followed does include a certain weightage for housing, the demand to pay HRA as

a percentage of Basic Pay + DA is not justified.

a percentage of Basic Pay + DA is not justified.

8.7.8 To arrive at the appropriate rates of HRA, the Commission used a two-fold approach: (i) It compared the rise in housing compensation with the cost of

housing in major X, Y and Z category cities over the period 2006 to 2013, and (ii) It compared, denovo, the HRA after the rise in Basic Pay proposed with

representative house rents in major X, Y and Z category cities.

housing in major X, Y and Z category cities over the period 2006 to 2013, and (ii) It compared, denovo, the HRA after the rise in Basic Pay proposed with

representative house rents in major X, Y and Z category cities.

8.7.9 For (i) above, the table of comparison (for a hypothetical employee whose Basic Pay was Rs.1000 in 2006) is given below:

| Table 230 : Rise in Housing Compensation in 2013 vis-à-vis 2006 | |||||||||||

|

Class of City

|

2006 | 2013 | |||||||||

| BP |

DA(0)

|

HRA |

15.27%

of DA |

Total Housing

Comp. (A) |

BP(7 increments

of 3%each) |

DA

(90% of BP) |

HRA |

15.27%

of DA |

Total Housing

Comp.(B) |

(B)/(A) | |

| X | 1000 | 0 | 300 | 0 | 300 | 1230 | 1107 | 369 | 169 | 538 | 1.79 |

| Y | 1000 | 0 | 200 | 0 | 200 | 1230 | 1107 | 246 | 169 | 415 | 2.07 |

| Z | 1000 | 0 | 100 | 0 | 100 | 1230 | 1107 | 123 | 169 | 292 | 2.92 |

8.7.10 As is clear from the above table, compensation for housing in 2013 was 1.79 times that in 2006 for Class X cities, 2.07 times for Class Y cities and

2.92 times for Class Z cities.

2.92 times for Class Z cities.

8.7.11 During the same period, the weighted (by population of cities) average rise 31 in housing index for Class X cities was 1.69 times, for thirty most

populated Class Y cities it was 2.10 times, and for twenty-five most populated Class Z cities it was also 2.10 times.

populated Class Y cities it was 2.10 times, and for twenty-five most populated Class Z cities it was also 2.10 times.

8.7.12 Thus, it can be safely concluded that the rise in housing compensation has largely kept pace with the rise in rental values in all categories of

cities.

cities.

8.7.13 However, if a zero-based comparison of HRA with house rents is carried out the Commission observed that today there are websites that give a good

idea of the prevalent house rents in various cities. From the information available on the websites, it was observed that with the increase in Basic Pay

proposed (and consequent rise in HRA with the rationalized percentages), most of the employees will be able to afford a rented house as per their

entitlement.

idea of the prevalent house rents in various cities. From the information available on the websites, it was observed that with the increase in Basic Pay

proposed (and consequent rise in HRA with the rationalized percentages), most of the employees will be able to afford a rented house as per their

entitlement.

percentages), most of the employees will be able to afford a rented house as per their

entitlement.

entitlement.

————–

30 The compensation for housing that is provided when Basic Pay is initially fixed has not been considered here.

31 Housing Index of AICPI(IW).

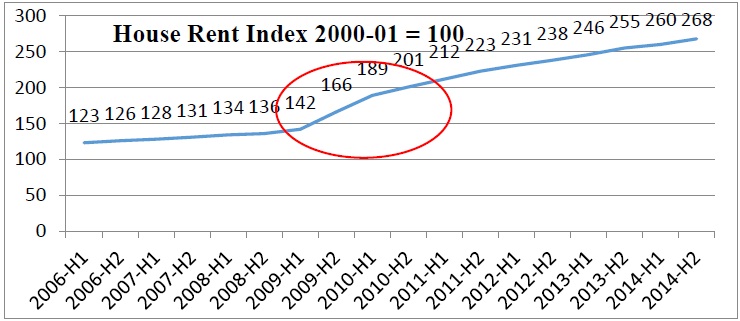

8.7.14 The Commission also took note of the link between increase in HRA and increase in house rent. There was a sharp rise in the index from the first

half of 2009, immediately following VI CPC recommendations. The All India House Rent Index 32 chart given below demonstrates this:

8.7.15 Considering all these factors, and in line with our general policy of rationalizing the percentage based allowances by a factor of 0.8, the

Commission recommends that HRA should be rationalized to 24 percent, 16 percent and 8 percent of the Basic Pay for Class X, Y and Z cities respectively. However, the Commission also recognizes that with the current formulation, once the new pay levels are implemented,

the compensation towards HRA will remain unchanged until such time as the pay and allowances are next revised. Going by the historical trend this event is

likely to be a decade away. Some representations have been received stating that towards the later part of the ten year period the HRA compensation falls

considerably short of the requirement. Having regard to this, the Commission also recommends that the rate of HRA will be revised to 27 percent, 18 percent and 9 percent when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

Commission recommends that HRA should be rationalized to 24 percent, 16 percent and 8 percent of the Basic Pay for Class X, Y and Z cities respectively. However, the Commission also recognizes that with the current formulation, once the new pay levels are implemented,

the compensation towards HRA will remain unchanged until such time as the pay and allowances are next revised. Going by the historical trend this event is

likely to be a decade away. Some representations have been received stating that towards the later part of the ten year period the HRA compensation falls

considerably short of the requirement. Having regard to this, the Commission also recommends that the rate of HRA will be revised to 27 percent, 18 percent and 9 percent when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

8.7.16 Currently, in the case of those drawing either NPA or MSP or both, HRA is being paid as a percentage of Basic Pay+NPA or Basic Pay+MSP or Basic

Pay+NPA+MSP respectively. HRA is a compensation for expenses in connection with the rent of the residential accommodation to be hired/leased by the

employee and is graded based on the level of the employee, and therefore should be calculated as a percentage of Basic Pay only. Add-ons like NPA, MSP, etc. should not be included while working out HRA.

Pay+NPA+MSP respectively. HRA is a compensation for expenses in connection with the rent of the residential accommodation to be hired/leased by the

employee and is graded based on the level of the employee, and therefore should be calculated as a percentage of Basic Pay only. Add-ons like NPA, MSP, etc. should not be included while working out HRA.

————–

32 Source: All India Consumer Price Index (Industrial Workers)

Housing

for

PBORs

in

Defence,

CAPFs

and

Indian

Coast

Guard

8.7.17 For a certain number of PBORs, there is an option to choose between HRA and Compensation in lieu of Quarters (CILQ). For the remaining, compensation

for housing is provided through Family Accommodation Allowance (FAA), and for certain ranks, through Single in Lieu of Quarters (SNLQ).

for housing is provided through Family Accommodation Allowance (FAA), and for certain ranks, through Single in Lieu of Quarters (SNLQ).

8.7.18 CILQ: The service conditions of the Defence Forces personnel demand that personnel reside in cantonments close to their Units.

The entitlement of accommodation, therefore, forms a part of service conditions. Keeping in view functional requirements, an authorization of married

establishment (by way of a specified percentage of the total establishment) has been decided by the government. PBORs who fall within this authorization

percentage and cannot be provided married accommodation are entitled to Compensation in lieu of quarters (CILQ). CILQ is a composite allowance, meant to

compensate for hiring of house, furniture, electricity and water etc. It is payable to PBORs who are married and are >=25 years of age. PBORs have the

option to choose CILQ or HRA, whichever is more beneficial. This allowance is also applicable to similarly placed personnel of CAPFs and Indian Coast

Guard. CILQ is payable at the following rates:

The entitlement of accommodation, therefore, forms a part of service conditions. Keeping in view functional requirements, an authorization of married

establishment (by way of a specified percentage of the total establishment) has been decided by the government. PBORs who fall within this authorization

percentage and cannot be provided married accommodation are entitled to Compensation in lieu of quarters (CILQ). CILQ is a composite allowance, meant to

compensate for hiring of house, furniture, electricity and water etc. It is payable to PBORs who are married and are >=25 years of age. PBORs have the

option to choose CILQ or HRA, whichever is more beneficial. This allowance is also applicable to similarly placed personnel of CAPFs and Indian Coast

Guard. CILQ is payable at the following rates:

(Rs.

per

month)

per

month)

| Posts | City Classification | ||

| X | Y | Z | |

| Sepoy/Naik | 5400 | 3600 | 2400 |

| Havaldar | 6300 | 4500 | 3000 |

| JCOs | 8100 | 5400 | 3600 |

| NC (E) | 2700 | 1800 | 1200 |

8.7.19 For the balance, compensation is through the FAA, which was introduced by the VI CPC. It is payable at the lowest rate of HRA

to all PBORs of Defence services, CAPFs and India Coast Guard who do not qualify for benefit of HRA or CILQ. In Ministry of Defence, it is granted at the

rate of 10 percent of Basic Pay, while in Ministry of Home, it is granted at a flat rate of Rs.1,050 pm.

to all PBORs of Defence services, CAPFs and India Coast Guard who do not qualify for benefit of HRA or CILQ. In Ministry of Defence, it is granted at the

rate of 10 percent of Basic Pay, while in Ministry of Home, it is granted at a flat rate of Rs.1,050 pm.

8.7.20 SNLQ is applicable to JCOs and equivalent personnel of Defence Forces only. When not provided with any type of accommodation at the

Duty Station, they are entitled to SNLQ which is equal to 2/3rd the rate of CILQ at that station, for their personal requirement, plus CILQ for their

families at the rate of a Class ‘Z’ city.

Duty Station, they are entitled to SNLQ which is equal to 2/3rd the rate of CILQ at that station, for their personal requirement, plus CILQ for their

families at the rate of a Class ‘Z’ city.

8.7.21 The present provisions can be understood with a simple example. Suppose for a particular rank, the provision of Authorized Married Establishment

(AME) is 50 percent and there are, say, 100 such personnel at that place. Then first 50 personnel can choose whether to opt for HRA or take CILQ. The

remaining 50 personnel are entitled onlyto FAA. When posted in Field areas, PBORs of Defence forces are entitled to HRA for their families at Selected Place

of Residence (SPR). However, no such provision is available in CAPFs or Coast Guard.

(AME) is 50 percent and there are, say, 100 such personnel at that place. Then first 50 personnel can choose whether to opt for HRA or take CILQ. The

remaining 50 personnel are entitled onlyto FAA. When posted in Field areas, PBORs of Defence forces are entitled to HRA for their families at Selected Place

of Residence (SPR). However, no such provision is available in CAPFs or Coast Guard.

8.7.22 There is a strong demand from PBORs of CAPFs and Coast Guard for being extended a similar benefit.

Analysis

and

Recommendations

and

Recommendations

8.7.23 There is no doubt that personnel of uniformed services are unique in several ways. They are required to stay in the field for long periods of time,

away from families. Even in non-field stations (peace stations), a minimum strength is required to be maintained in the barracks for quick deployment at

short notice.

away from families. Even in non-field stations (peace stations), a minimum strength is required to be maintained in the barracks for quick deployment at

short notice.

8.7.24 It is noted by the Commission that there was a time when these personnel could leave their families behind in villages and go for field postings.

However, times have changed. Many of these PBORs have working spouses and harbor legitimate expectations of raising their children in urban areas.

However, times have changed. Many of these PBORs have working spouses and harbor legitimate expectations of raising their children in urban areas.

8.7.25 With the AME percentage being limited, personnel take turns to fit into the AME percentage. An employee who is married but is less than 25 years of

age is not entitled for AME at all, and therefore cannot avail CILQ. In the current context the provisions of AME as well as the stipulation of minimum 25

years of age to occupythese establishments are outdated and need revisiting.

age is not entitled for AME at all, and therefore cannot avail CILQ. In the current context the provisions of AME as well as the stipulation of minimum 25

years of age to occupythese establishments are outdated and need revisiting.

8.7.26 It is felt that the service rendered by PBORs of uniformed services needs to be recognized and their housing provisions simplified. The Commission,

in the interactions it has had with the men on the ground at all field locations it has visited, has seen firsthand that the lack of proper housing

compensation is a source of discontentment among these employees. Hence, the following structure is recommended:

in the interactions it has had with the men on the ground at all field locations it has visited, has seen firsthand that the lack of proper housing

compensation is a source of discontentment among these employees. Hence, the following structure is recommended:

|

Whether the

PBOR has any Dependents |

Field Posting | Non-Field Posting | |

| Staying in Barracks |

Not Staying in Barracks

|

||

| Yes | Full HRA applicable at the Selected Place of Residence of the Dependents* |

Reduced HRA applicable at the Selected Place of Residence of the Dependents** |

Full HRA applicable at that place if government accommodation not available# |

| No | Full HRA applicable at Class Z city, i.e., 10 percent of Basic Pay |

Reduced HRA applicable at the place of posting@ | Full HRA applicable at that place if government accommodation not available # |

An

employee

with

dependents,

during

field

posting

or

staying

in

Barracks

as

functional

requirement

will

be

eligible

for

accommodation

for

his

dependents

anywhere

in

the

country.

employee

with

dependents,

during

field

posting

or

staying

in

Barracks

as

functional

requirement

will

be

eligible

for

accommodation

for

his

dependents

anywhere

in

the

country.

*

Provided

government

accommodation

is

not

available

for

the

dependents

at

Selected

Place

of Residence.

If

government

accommodation

is

available,

no

HRA

is

payable.

Provided

government

accommodation

is

not

available

for

the

dependents

at

Selected

Place

of Residence.

If

government

accommodation

is

available,

no

HRA

is

payable.

**

Reduced

H

RA

means

rate

of

HRA

a

pplicable

reduced

by

5

percent.

However,

the

reduced

amount

cannot

be

less

than

the

lowest

rate

of

HRA

applicable

to

Class

Z

cities/towns.

Allowance

is

available

provided

employee

is

required

to

stay

in

barracks

as

a

functional

requirement

and

government

accommodation

is

not

available

for

the

dependents

at

Selected

Place

of

Residence.

If

employee

is

staying

in

barracks

by

choice

or

government

accommodation

is

available

at

Selected

Place

of

Residence,

no

HRA

is

payable.

Reduced

H

RA

means

rate

of

HRA

a

pplicable

reduced

by

5

percent.

However,

the

reduced

amount

cannot

be

less

than

the

lowest

rate

of

HRA

applicable

to

Class

Z

cities/towns.

Allowance

is

available

provided

employee

is

required

to

stay

in

barracks

as

a

functional

requirement

and

government

accommodation

is

not

available

for

the

dependents

at

Selected

Place

of

Residence.

If

employee

is

staying

in

barracks

by

choice

or

government

accommodation

is

available

at

Selected

Place

of

Residence,

no

HRA

is

payable.

@

Reduced

H

RA

m

eans

rate

of

H

RA

applicable

r

educed

by

5

%

.

H

owever,

t

he

reduced

amount

cannot

be

less

than

the

lowest

rate

of

HRA

applicable

to

Class

Z

cities/towns.

Allowance

is available

provided

employee

is

required

to

stay

in

Barracks

as

a

functional

requirement.

If

employee

is

staying

in

Barracks

by

choice,

no

HRA

is

payable.

Reduced

H

RA

m

eans

rate

of

H

RA

applicable

r

educed

by

5

%

.

H

owever,

t

he

reduced

amount

cannot

be

less

than

the

lowest

rate

of

HRA

applicable

to

Class

Z

cities/towns.

Allowance

is available

provided

employee

is

required

to

stay

in

Barracks

as

a

functional

requirement.

If

employee

is

staying

in

Barracks

by

choice,

no

HRA

is

payable.

#

Provided

government

accommodation

is

not

available,

else

no

HRA

is

payable.

Provided

government

accommodation

is

not

available,

else

no

HRA

is

payable.

8.7.27 Staying in barracks cannot be equated with provision of adequate housing. Hence, some compensation is provided for those personnel who are required

to stay in barracks as a functional requirement in the form of Reduced HRA. The restrictions related to Authorized Married Establishment, 25 years of age

as well as the concept of Separated Family Accommodation should be done away with. CILQ, FAA and SNLQ should also be abolished.

to stay in barracks as a functional requirement in the form of Reduced HRA. The restrictions related to Authorized Married Establishment, 25 years of age

as well as the concept of Separated Family Accommodation should be done away with. CILQ, FAA and SNLQ should also be abolished.

Hutting

Allowance

Allowance

8.7.28 This allowance is granted to Railway servants living outside Railway premises who, for the outbreak of plague in epidemic forms, are compelled to

vacate their houses and to erect temporary huts on Railway land or elsewhere. The present rate of the allowance is Rs.100 pm. No demands have been received

regarding this allowance.

vacate their houses and to erect temporary huts on Railway land or elsewhere. The present rate of the allowance is Rs.100 pm. No demands have been received

regarding this allowance.

Analysis

and

Recommendations

and

Recommendations

8.7.29 The allowance is outdated. It is recommended for deletion.

Family

HRA

Allowance

8.7.30 This allowance is granted to Central Government servants posted in NE region to compensate for the cost of stay of their families if they are left

behind at the last place of posting before proceeding to NE region. In lieu of this allowance, employees are allowed to retain their house at the last

place of posting, if they are posted in NE region, and allowed to draw HRA in NE region as well. No demands have been received regarding this allowance.

behind at the last place of posting before proceeding to NE region. In lieu of this allowance, employees are allowed to retain their house at the last

place of posting, if they are posted in NE region, and allowed to draw HRA in NE region as well. No demands have been received regarding this allowance.

Analysis

and

Recommendations

and

Recommendations

8.7.31 This allowance is in the nature of an incentive for posting to North Eastern region. It is recommended that this allowance should be extended to postings in the Island territories of Andaman, Nicobar and Lakshadweep also.

Rent

Free

Accommodation

8.7.32 This allowance is granted to IB personnel on confrere (a fellow member of a profession, fraternity, etc.) basis, if admissible to police personnel

of equivalent rank at that station. No demands have been received regarding this allowance.

of equivalent rank at that station. No demands have been received regarding this allowance.

Analysis

and

Recommendation

and

Recommendation

8.7.33 The Commission opines that the allowance is outdated. Hence, it is recommended for deletion.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

If a married defence pbor personal posted at field unit,age below 25 years and his family is residing at some other places ,can he get hra?

If a defence married( pbor )personal who is below 25years of age and posted in field unit,he has not registered for married accommodation.and his family is residing at some other places ,can he claim hra?

If a person is serving in CPMF,S, and quarter is available at his duty place but he keeps his family at other station due to his own, is he entitled for HRA