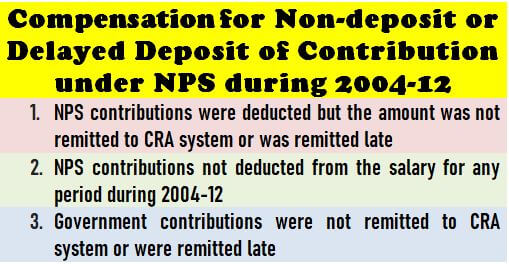

CGA: Compensation for Non-deposit or Delayed Deposit of Contribution under NPS during 2004-12 – reg.

No. 1(7)/2019/TA-III/12

Ministry of Finance

Department of Expenditure

Controller General of Accounts

Mahalekha Niyantrak Bhawan

‘E’ Block, GPO Complex, INA

New Delhi – 110022

Dated: 7th January, 2020

OFFICE MEMORANDUM

Subject: Compensation for Non-deposit or Delayed Deposit of Contribution under National Pension System during 2004-12 – Reg.

Reference is invited to Department of Expenditure (DoE), Ministry of Finance OM No. 4(21)/EV/2018 dated 12 April, 2019 (copy enclosed) which, inter-alia, includes decision of the Department of Financial Services (DFS), Ministry of Finance vide clause 1(2)(x), 1(2)(xi) and 1(2)(xii) of Gazette Notification dated 31.01.2019 regarding compensation for Non-deposit or delayed deposit of contribution under National Pension System during 2004 to 2012,

2. In pursuance of instructions/guidelines contained in DoE OM No. 1(21)/EV/2018 dated 12 April, 2019, the following guidelines for implementation of the decision contained in DFS Notification dated 31.01.2019 are hereby issued:

(a) In all cases, where the NPS contributions were deducted from the salary of the Government employee but the amount was not remitted to Central Record Keeping Agency (CRA) system or was remitted late:

The amount of contributions may be credited to the NPS account of the employee along with interest for the period from the date on which the deductions were made till the date the amount is/was actually credited to the NPS account of the employee, as per the rates applicable to GPF from time to time, compounded annually.

The period of delay shall be reckoned from the last working day of month of deduction of NPS contributions till the same were remitted to CRA system. Similarly, in case of month of March, the period of delay shall be reckoned from the first working day of April of the respective financial year.

The interest shall be calculated by the present DDO of the employee concerned on the basis of data provided by the Central Record Keeping Agency (NSDL) in confirmation with service records. of the employee. A confirmation to the correctness of data/records may also be obtained from the employee concerned.

In case any discrepancy is reported by the employee for a period not falling under the current DDO, the DDO shall go ahead with available records and calculate the interest and proceed further to avoid any delay.

The reported discrepancy shall, however, be verified by the current DDO on the basis of PBR(s) available with previous DDO(s) and corrective action, if required, may be taken at later stage.

After calculating the interest, the DDO shall prepare and prefer the bill to PAO/CDDO clearly mentioning the employee details viz. PRAN, period and interest amount etc.

The PAO/CDDO shall, after reconciliation of the bill details with data received from the NSDL upload the Subscriber Contribution Files (SCFs) into NSDL system. The interest amount shall be debited to a new sub-head (to be opened) under “2071-Pensions and Other Retirement Benefits, 117-Government Contribution for Defined Contribution Pension Scheme” and crediting the Head: “0071-Contributions and Recoveries towards Pension and Other Retirement Benefits, 500-Receipts Awaiting Transfer to other Minor Heads (RAT)”.

The aforesaid new sub-head – “Interest on Non-Deposit or Delayed Deposit of NPS Contributions” shall be opened by this office to ensure uniformity across all pension accounting organizations and timely implementation of the decision.

The PAO/CDDO shall make payment of interest by minus crediting the ‘RAT’ and remit the interest amount to the NPS trustee bank through the accredited bank ensuring that there are no balances under RAT by end of the month of transaction.

(b) All the cases where the NPS contributions not deducted from the salary of the government employee for any period during 2004-12:

The employee may be given option to deposit amount of employee contribution now. In case he opts to deposit the contribution now, the amount may be deposited in one lump sum or in monthly installments. The amount of installment may be deducted from the salary of the Government employee and deposit in his NPS account. The same may qualify for tax concessions under Income Tax Act as applicable to the mandatory contribution of the employee.

In case the employee opts for depositing the amount in one lump sum, the DDO shall work out the amount in confirmation with the service records of the employee. On receipt of such amount from the employee, the DDO shall deposit the same into accredited bank through challan with a copy endorsed to the PAO/CDDO along with details of employee viz. PRAN, amount and period of contributions etc.

On receipt of Receipt Scroll from the accredited bank the PAO/CDDO shall after reconciliation of data provided by the DDO and CRA book the receipt by crediting the Head “0071-Contributions and Recoveries towards Pension and Other Retirement Benefits, 500-Receipts Awaiting Transfer to other Minor Heads (RAT)”, upload the SCFs into CRA system and remit the amount to the NPS trustee bank through accredited bank by minus crediting ‘RAT’ ensuring that there is no balance under ‘RAT’ at end of the month of the transaction.

If the employee opts for payment in installments, the DDO shall, work out the amount in confirmation with service records of the employee and deduct the same from the salary bills in installments and prefer the bills to PAO/CDDO indicating employee details viz. PRAN, period of pending contributions, number of installments etc. The PAO shall after proper reconciliation upload the SCFs into CRA system clearly indicating “employee’s arrear contributions”. Subsequently, the PAO/CDDO shall pass the bill by debiting the respective “Salary Head” and crediting “0071-Contributions and Recoveries towards Pension and Other Retirement Benefits, 500-Receipts Awaiting Transfer to other Minor Heads (RAT)”and remit the amount to NPS trustee bank through the accredited bank by minus crediting ‘RAT’ ensuring there is no balance under ‘RAT’ at the end of the month of the transaction.

(c) In all cases where the government contributions were not remitted to CRA system or were remitted late (irrespective whether the employee contributions were deducted or not):

The amount of Government contributions may be credited to the NPS account of the employee along with interest for the period from the date on which the Government contributions were due till the date the amount is actually credited to the NPS account of the employee, as per rates applicable to GPF from time to time.

The delay in this case shall be reckoned from the last working day of the month the government contribution became due. Similarly, in case of month of March, first working day of April of respective financial year may be reckoned for calculating period of delay.

In-all such cases the DDO shall, on the basis of data provided by CRA and in confirmation with records of the employee, work out the amount of Government contributions and prefer the bill to PAO/CDDO. The PAO/CDDO shall, after due reconciliation of data, book the amount by debiting the head “2071-Pensions and Other Retirement Benefits, 117-Government Contribution for Defined Contribution Pension Scheme” and crediting the Head “0071-Contributions and Recoveries towards Pension and Other Retirement Benefits, 500-Receipts Awaiting Transfer to other Minor Heads (RAT)”. The PAO shall remit the amount by minus crediting ‘RAT’ to NPS trustee bank through the accredited bank ensuring that there is no balance under ‘RAT’ by end of the month of the transaction. The SCFs uploaded in this regard shall clearly indicate “Government’s arrear contributions”.

The procedure for calculating interest and payment/remittance to trustee bank may be followed in the same manner as prescribed in 2(a) above.

3. The NSDL shall identify from its records all such cases which are covered under the decision contained in the DFS notification dated 31.01.2019 and pass on such employees-wise details, on its own, to the concerned. Head of Office and DDO/PAO, where the employee is currently posted. This data, however, is secondary in nature and, therefore, HoO/DDO/CDDO/PAO are required to reconcile the same with the data/records available with them before preferring/passing the bills for payment to trustee bank.

4. “NSDL may also update their system with necessary technical modalities for capturing the details of employees arrear contributions, government arrear contribution, interest amount etc. in SCFs uploaded by the nodal offices to ensure seamless matching and booking of contributions and interest amount.

5. The period of 2004-2012 would be reckoned in term of calendar years i.e. 01.01.2004 to 31. 12. 2012. All cases of delay may be resolved within a period of three months.

6. This issues with the approval of the Controller General of Accounts.

(Sanjeev Shrivastava)

Joint Controller General of Accounts

Source: Click here to view/download the PDF

[http://cga.nic.in//writereaddata/file/NPSComp12070120.pdf]

COMMENTS