BSNL Voluntary Retirement Scheme-2019- Frequently Asked Questions

BHARAT SANCHAR NIGAM LIMITED

(A Govt.of India Enterprise)

BSNL Corporate Office

Establishment Branch,

PAT Section, 5th floor,

Bharat Sanchar Bhawan

H.C. Mathur Lane, New Delhi-110001

F.No. 1-15/2019-PAT(BSNL)-Part

Dated : 07.11.2019

To,

All Heads of Telecom Circles

BSNL

Subject: – BSNL Voluntary Retirement Scheme-2019- Frequently Asked Questions.

Consequent upon notification of the BSNL Voluntary Retirement Scheme-2019 and circulation of guidelines vide this office letter of even number dated 04.11.2019 , it is felt that there may be some queries in the mind of the eligible officials. In order to provide further clarity about the scheme some frequently asked questions (FAQs) have been prepared along with their reply and the same are annexed to this letter for guidelines and vide publicity among the eligible officials.

Yours Sincerely,

(A.K. Singh)

Deputy General Manager (Estt-II)

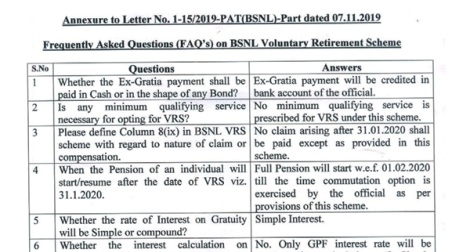

Annexure to Letter No. 1-15/2019-PAT(BSNL)-Part dated 07.11.2019

Frequently Asked Questions (FAQ’s) on BSNL Voluntary Retirement Scheme

| S. No | Questions | Answers |

| I | Whether the Ex-Gratia payment shall be paid in Cash or in the shape of any Bond? | Ex-Gratia payment will be credited in bank account of the official. |

| 2 | Is any minimum qualifying service necessary for opting for VRS? | No minimum qualifying service is prescribed for VRS under this scheme. |

| 3 | Please define Column 8(ix) in BSNL VRS scheme with regard to nature of claim or compensation. | No claim arising after 31.01.2020 shall be paid except as provided m this scheme. |

| 4 | When the Pension of an individual will start/resume after the date of VRS viz. 31.1.2020. | Full Pension will start w.e.f. 01.02.2020 till the time commutation option is exercised by the official as per provisions of this scheme. |

| 5 | Whether the rate of Interest on Gratuity will be Simple or compound? | Simple Interest. |

| 6 | Whether the interest calculation on deferred Gratuity will be done in the manner similar to interest calculation applied for GPF? | No. Only GPF interest rate will be applied for calculation of Simple interest. |

| 7 | Whether the rate of interest on deferred Gratuity payment shall vary with change in GPF interest rate? | Yes, it will change with change in GPF interest rates. |

| 8 | Whether an official having less than 6 months of service left for actual superannuation is eligible to take VRS? | Yes. Eligible officials who are due for superannuation after 31.01.2020 are eligible for opting VRS. |

| 9 | Whether the benefit of NEPP/EPP shall be given in respect of those officials/officers who are due for upgradation prior to 31.1.2020? | Yes. It will be granted, if due before 31.01.2020, w.e.f. due date. |

| 10 | Whether the Ex-Gratia amount is exempted under Income Tax? | Income tax will be charged as per extant Rules of Income Tax Act. |

| 11 | Whether the BSNL Quarters can be retained up to the age of superannuation viz. 60 years? | Retention of staff quarter will be as per existing rules, as amended from time to time. |

| 12 | What is the last date of filing Pension Papers in the event of opting for YRS? | Pension papers can be submitted soon after exercising option for VRS. |

| 13 | Whether VRS optees are eligible for CGHS facility at par with BSNL official retiring on superannuation? | Only BSNL absorbed officials, covered under Rule 37-A of CCS (Pension) Rules, opting for VRS are eligible for CGHS facility |

| 14 | Whether stagnation increments will be considered for calculation of Ex-gratia? | Yes |

| 15 | Whether an optee of VRS can subsequently be allowed to withdraw or change his option? | Yes, the officials will be allowed to withdraw the option only once at anytime till the closing time and date of option. After withdrawal, official can again opt for VRS, within prescribed date & time but will not be allowed to withdraw again. |

| 16 | Whether the annual increment benefit will be extended to the VRS Optees whose DNIfalls on 01.02.2020 as the employee already completed 365 days of service as on 31.01.2020? | No |

| 17 | As the Ex-gratia amount is being paid in two :financial years, 2019-20 and 2020-21, whether the income Tax Exemption of Rs 5 Lakhs is applicable in each financial year or not? | It will be as per the extant Income Tax Rules. |

| 18 | When will be the GPF and Leave encashment amount will be paid to the VRS optees, immediately after the retirement or not? | Yes, it will be paid immediately after the retirement. |

| 19 | To reduce the Medical reimbursement amount to BSNL for all those who optedfor CGHS, whether the entire amount towards CGHS contribution will be reimbursed by BSNL to the VRS Optees immediately. | Yes. |

| 20 | Whether the Time bound promotion benefit will be extended to the YRS Optees whose Time bound promotion is due in February 2020 as the employee already completed 5 years of service as on 31.01.2020?. | No. |

COMMENTS