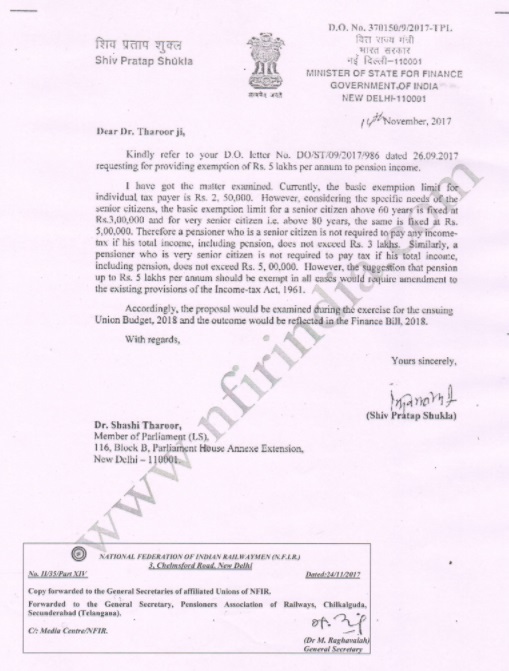

Shiva Pratap Shukla

MINISTER OF STATE FOR FINANCE

GOVERNMENT OF INDIA

NEW DELHI-110001

14th November 2017

Dear Dr.Tharoor Ji,

Kindly refer to your D.O. letter No. DO/S1/09/2017/986 dated 26.09.2017 requesting, for providing the exemption of Rs. 5 lakhs per annum to pension income.

I have got the matter examined. Currently, the basic exemption limit for individual taxpayer is Rs, 2, 50,000, However, considering the specific needs of the senior citizens, the basic exemption limit for a senior citizen above 60 year, is fixed at Rs.3,00,000 and for very senior citizen i.e. above 80 years, the same is fixed Rs. 5,00,000. Therefore, a pensioner who is a senior citizen is not required to pay any income-tax if his. total income, including pension., does not exceed Rs. 3 lakhs Similarly, a pensioner who is very senior citizen is not required to pay tax if his total income, including pension, does not exceed Rs. 5, 00.000. However, the suggestions that pension up to Rs. 5 lakhs per annum should be exempt in all cases would require amendment to the existing provisions of the Income-tax Act, 1964.

Accordingly, the proposal would be examined during the exercise for the ensuing Union Budget, 2018 and the outcome would be reflected in the Finance Bill 2018.

Yours sincerely,

COMMENTS

Sir it not correct ,those pensioners age above 80 yeras, are only authoredsed Tax Exemption Rs Five Lakh, sir just thinks in your mind that at this present time how moch pensiners Leave long life ?. so, we request to sift from 80 years age to 70 or 75 years age sor verisiniors pensiners benifited.

thaks if your kind attention will go to this paoints, so old aged pensioners will leave with ount tention.

Thanks

Ex-Hav Arjunhai I.Oza.

Rtd from A.S.C. (Supply)

date of Retirement 19/10/1979.

If the total income of any pensioner above 60 years is brought at par with the pensioner of very Sr.pensioner ,it would be the reflection of equality and good justice of all pensioners after superannuation at the age of 60 years.