Grant of increment to the retiring employees on the date of their retirement 30th June/31st Dec , if the date of their increment follows their date of retirement – Amendment to the rules governing grant of increment & extension of the amended rule to pensioners as a one-time measure: Minutes of the 33rd SCOVA meeting

[DoP&PW OM No. 42/11/2023-P&PW(D) dated 03.04.2024]

Sub:- Minutes of the 33rd SCOVA meeting held under the Chairmanship of Hon’ ble MOS(PP) on 22.02.2024, at Vigyan Bhawan, New Delhi-reg

Previous: (33.2):- Railways fare concession must be allowed to Senior Citizens/Pensioners as per pre-Covid period.

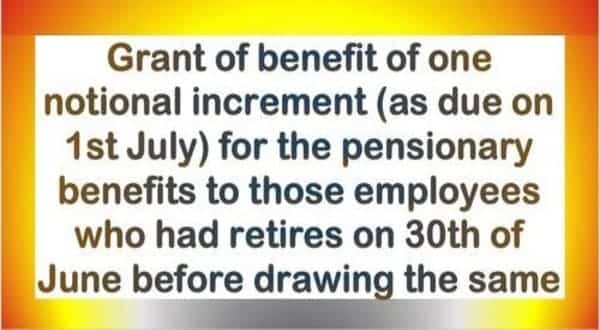

(33.3) Grant of increment to the retiring employees on the date of their retirement, if the date of their increment follows their date of retirement – Amendment to the rules governing grant of increment & extension of the amended rule to pensioners as a one-time measure

Grant of increment to a pensioner is contrary to the personnel policy of the Government” may perhaps be because of the reason that the Rules governing grant of increment stipulate that the employee must be on duty on the date on which he earns an increment and if the employee is not on duty, the increment shall be granted from the date of resumption of duty. Therefore, if the date of increment of an employee falls on the next date of his retirement, the increment that would have been allowed to him but for his retirement is not granted for the reason that the employee, having retired from service, is not on duty on the date on which the increment would have been otherwise granted to him.

The provisions of the rules, as they stand now, have made such employees ineligible for increment even after rendering 365 days of service after earning the last increment. The Rules on grant of increment have undergone many changes and modifications have been made in the past on several occasions, which were to the advantage of the employees and the retiring employees as well. Hence, suitable amendment may be considered

Discussion/Decision taken in the meeting

Joint Secretary, DoPT informed that as per the existing rule provisions regulating annual increment, fulfillment of the following conditions is mandatory for a Government servant to earn the annual increment :-

(i) the Government servant must be in service on the date on which the increment falls due and;

(ii) he should have rendered satisfactory work and displayed good conduct during the one year period preceding the date on which the increment falls due.

He further added that the demand for amending the existing rule provisions governing annual increment is apparently based on the Hon’ble Surpeme Court’s Order dated 11.04.2023 in Civil Appeal No. 2471 of 2023 @ SLP (C) No. 6185/2020-KPTCL VS. CP Mundinamani & Ors.

DoPT representative also informed that the matter was examined in consultation with other nodal Ministries/Departments like Department of Expenditure, Department of Legal Affairs etc. Further, Ld. Attorney General of India has also been consulted in the matter and based on the advice received, efforts are being made to seek clarification from the Hon’ble Supreme Court on the relevant issues-including rule provisions-which need elucidation. Further action, as may be required in the wake of Orders of the Hon’ble Supreme Court, can be taken on completion on the said exercise.

The Chairman, SCOVA directed DoPT to examine this issue in consultation with Ld. Attorney General expeditiously.

(Action : Department of Personnel & Training)

Next: (33.4) Construction of CGHS Polyclinic/ Hospital at Jammu

COMMENTS

Grant of increment to the retiring employees on the date of their retirement, if the date of their increment follows their date of retirement. Who are eligible if the government agreed with the proposal?? Or only the Railway employees are entitled. Please clarify.

When the courts clearly directed the respondents to grant the notional increment. The respondents have to comply and cannot come up with flimsy issues.

Courts after due examination and deliberations only came to the conclusion that the increment.due has to be paid, not withstanding whether there person was on duty or otherwise in the DNI

I have retired on 30th june 2019 from Kharagpur workshop 55,under Dy.C.E E/ws,S.E.Rly,pls needful help me for annual increment at the earliest.

The moot point is when a government employee rendered requisite length of service & earned annual increment with good conduct & behaviour then it becomes the property of that person & the same cannot be denied , forfeited or withheld merely on the grounds that he is not in service on next day owing to his retirement on superannuation ,Despite of Supreme Court verdicts dated 11.04.2023 & subsequent dated 19th May 2023 even after a lapse of one year period is not only unfortunate but shows that how the government agencies are working in the regime of present government with flagrant disregards of the Constitutional provisions enshrined under articles 14 & the 16 of India.We have been appreciating lot many good deeds of a government, & if anything found unfair & unreasonable have to be criticised & this right of a citizen should not suppressed.

The moot point is when a government employee rendered requisite length of service & earned annual increment with good conduct & behaviour then it becomes the property of that person & the same cannot be denied , forfeited or withheld merely on the grounds that he is not in service on next day owing to his retirement in superannuation . Despite of Supreme Court verdicts dated 11.04.2023 & subsequent dated 19th May 2023 even after a lapse of one year period is not only unfortunate but shows that how the government agencies are working in the regime of present government.