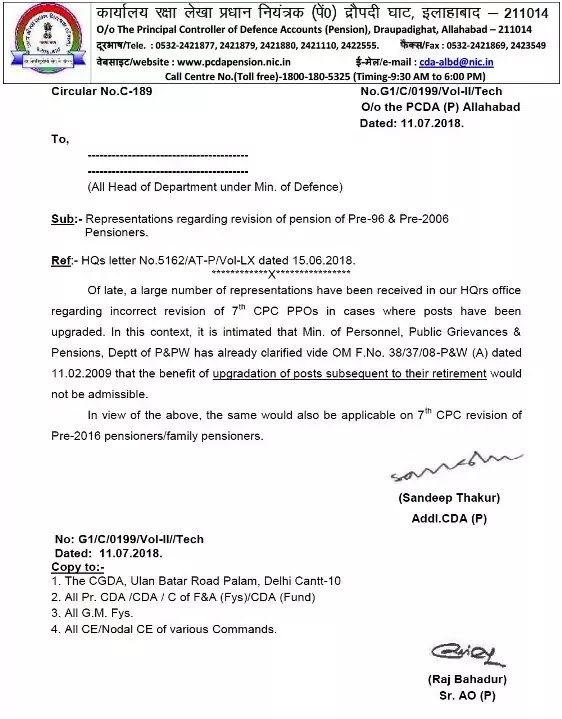

Sub:- Representations regarding revision of pension of Pre-96 &

Pre-2006 Pensioners.

Ref:- HQs letter No.5162/AT-P/Vol-LX dated 15.06.2018.

office regarding incorrect revision of 7th CPC PPOs in cases where posts have been upgraded. In this context, it is intimated that Min. of Personnel, Public

Grievances Pensions, Deptt of P&PW has already clarified vide OM F.No.

38/37/08-P&W (A) dated 11.02.2009 that the benefit of upgradation of posts subsequent to their

retirement would not be admissible.

of Pre-2016 pensioners/family pensioners.

Subject:- Representations regarding revision of pension of pre-2006 pensioners.

The undersigned is directed to say that in accordance with instructions contained in para 4.2 of this Department’s OM of even number dated 1.92008,

the fixation of pension will be subject to the provision that the revised

pension, in no case, shall be lower than fifty percent of’ the minimum of the pay in the

pay band plus the grade pay corresponding to the pre-revised pay scale from which the

pensioner had retired. In the case of HAG+ and above scales, this will be fifty

percent of the minimum of the revised pay scale. It was clarified in the OM dated

3.10.2008 that the pension calculated at 50% of the minimum of pay in the pay band plus grade

pay would be calculated at the minimum of the pay in the pay band (irrespective

of the pre-revised scale of pay) plus the grade pay corresponding to the

pre-revised pay scale. The pension will be reduced pro-rata, where the pensioner had less

than the maximum required service for full pension as per rule 49 of the

CCS(Pension) Rules, 1972 as applicable before 29.2008 and in no case it will be less than Rs.

3500/- pm. The fixation of family pension will be subject to the provision that the

revised family pension, in no case, shall be lower than thirty percent of the sum of the

minimum of the pay in the pay band and the grade pay thereon corresponding to the

pre-revised pay scale from which the pensioner had retired. A Table indicating the

revised pension based on revised pay bands and grade pay was also annexed. with

this Department’s OM dated 14.10.2008.

2. A large number of representations/references are being received in this Department raising the following issues:

(i) It has been alleged that the above instructions are discriminatory/anomalous and are not in conformity with the decision taken on the recommendations of the Sixth Central Pay Commission;

(ii) It has been suggested that certain pre-2006 scales of pay should be allowed pay band/grade pay or pay scales higher than that mentioned in Col. 6 in Annexure 1 to O.M. dated 14.10.2008;

(iii) It has been suggested that in cases where certain posts have been upgraded and allowed higher pay band/grade pay or pay scale, the application of the provision in para 42 of the OM dated 1.9.2008 (as clarified from time to time) should be with reference to the upgraded pay band/grade pay or pay scale.

are in consonance with the decision of the Government on the recommendations of

the Sixth Central Pay Commission and no change is required to be made in this

respect.

based on the CCS(Revised Rules), 2008 which are applicable to the employees in

the service as on 11.2006 and no dispensation in this regard can be made in

respect of pre-2006 pensioners for the purpose of application of the provision of Para

4.2 of this Department’s OM dated 1.92008.

Department’s OM of even number dated 1.9.2008, the fixation of pension will be subject

to the provision that the revised pension, in no case, shall be lower than fifty

percent of the minimum of the pay in the pay band plus the grade pay corresponding to the

pre- revised pay scale from which the pensioner had retired. Therefore, the

benefit of upgradation of posts subsequent to their retirement would not be admissible

to the pre-2006 pensioners in this regard.

COMMENTS

The above OM has been quashed by Hon'bLe Prl. Bench, NEW Delhi in order dated

1-11-2011 and it has reached finality with confirmation by the High Court and

dismissal of SLP by the Supreme Court. Subsequently this decision was relied on

and relief allowed in many cases. The OM is therefore non est.