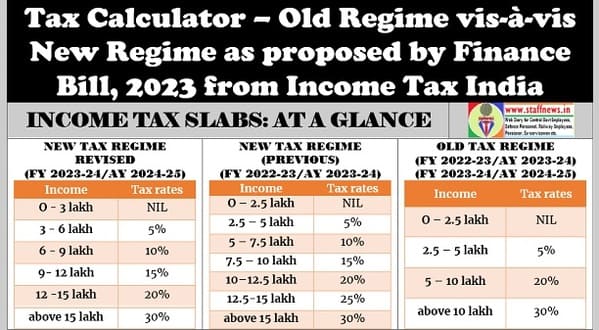

Tax Calculator – Old Regime vis-à-vis New Regime as proposed by Finance Bill, 2023 from IncomeTaxIndia

Finance Minister Nirmala Sitharaman has in Budget 2023 announced slew of changes in income tax slabs under the new tax regime. The key changes announced on February 1, 2023, are:

Changes in the income tax slabs under the new tax regime

Standard deduction introduced for salaried individuals, pensioners under the new tax regime

- Basic exemption limit hiked to Rs 3 lakh from Rs 2.5 lakh under the new tax regime

- Highest surcharge rate reduced to 25% from 37% under the new tax regime

- Rebate under Section 87A increased to taxable income of Rs 7 lakh under the new tax regime from Rs 5 lakh earlier. This would mean that from FY 2023-24, individuals having taxable incomes up to Rs 7 lakh and opting for the new tax regime will effectively pay zero taxes

The new tax regime would be the default option for taxpayers. However, an individual can choose to opt for the old tax regime.

Revised Tax Slabs under New Tax Regime

| Income tax slabs under new tax regime | Income tax rates under new tax regime |

| O to Rs 3 lakh | 0 |

| Rs 3 lakh to Rs 6 lakh | 5% |

| Rs 6 lakh to Rs 9 lakh | 10% |

| Rs 9 lakh to Rs 12 lakh | 15% |

| Rs 12 lakh to Rs 15 lakh | 20% |

| Income above Rs 15 lakh | 30% |

*Cess at the rate of 4% will be added to the income tax amount

*Surcharge will be applicable on taxable incomes above Rs 50 lakh

Do note that these changes will be applicable from April 1, 2023, for FY 2023-24. So, in April, when you submit the investment declarations to your employer for calculation of taxes on salary for FY 2023-24, your employer will assume that you have opted for the new tax regime unless you specify otherwise.

However, while filing income tax returns for FY 2022-23 (ending on March 31, 2023) or AY 2023-24, you will continue to use the existing new income tax regime or old tax regime, depending on what you had chosen.

Here are the income tax slabs for FY 2022-23 that you will need to file income tax return this year.

Income tax slabs under existing new tax regime for FY 2022-23

| Income tax slabs (In Rs) | Income tax rate (%) |

| From 0 to 2,50,000 | 0% |

| From 2,50,001 to Rs 5,00,000 | 5% |

| From 5,00,001 to 7,50,000 | 10% |

| From 7,50,001 to 10,00,000 | 15% |

| From 10,00,001 to 12,50,000 | 20% |

| From 12,50,001 to 15,00,000 | 25% |

| From 15,00,001 | 30% |

Income tax slabs under the old tax regime for FY 2022-23

| Income tax slabs (In Rs) | Income tax rate (%) |

| From 0 to 2,50,000 | 0% |

| From 2,50,001 to 5,00,000 | 5% |

| From 5,00,001 to 10,00,000 | 20% |

| From 10,00,001 | 30% |

Cess will be applicable at 4% on the income tax payable for FY 2022-23. Further, surcharge will be applicable on taxable incomes above Rs 50 lakh. A rebate under Section 87A will be available in both tax regimes for taxable incomes up to Rs 5 lakh for FY 2022-23.

Revised Tax Slabs under New Tax Regime

| Income tax slabs (In Rs) | Income tax rate (%) |

| From 0 to 3,00,000 | 0 |

| From 3,00,001 to 6,00,000 | 5% |

| From 6,00,001 to 9,00,000 | 10% |

| From 9,00,001 to 12,00,000 | 15% |

| From 12,00,001 to 15,00,000 | 20% |

| From 15,00,001 | 30% |

Tax Calculator – Old Regime vis-à-vis New Regime as proposed by Finance Bill, 2023 from IncomeTaxIndia

For Individual/ HUF/ AOP/ BOI/ Artificial Juridical Person (AJP)

as per section 115BAC proposed by Finance Bill, 2023

COMMENTS

Half baked information furnished by income tax department. Deduction allowed by GOI not shown ?