Entitlement of TA on Retirement on Cash Basis: PCDA(O), Pune – Advisory No. 30

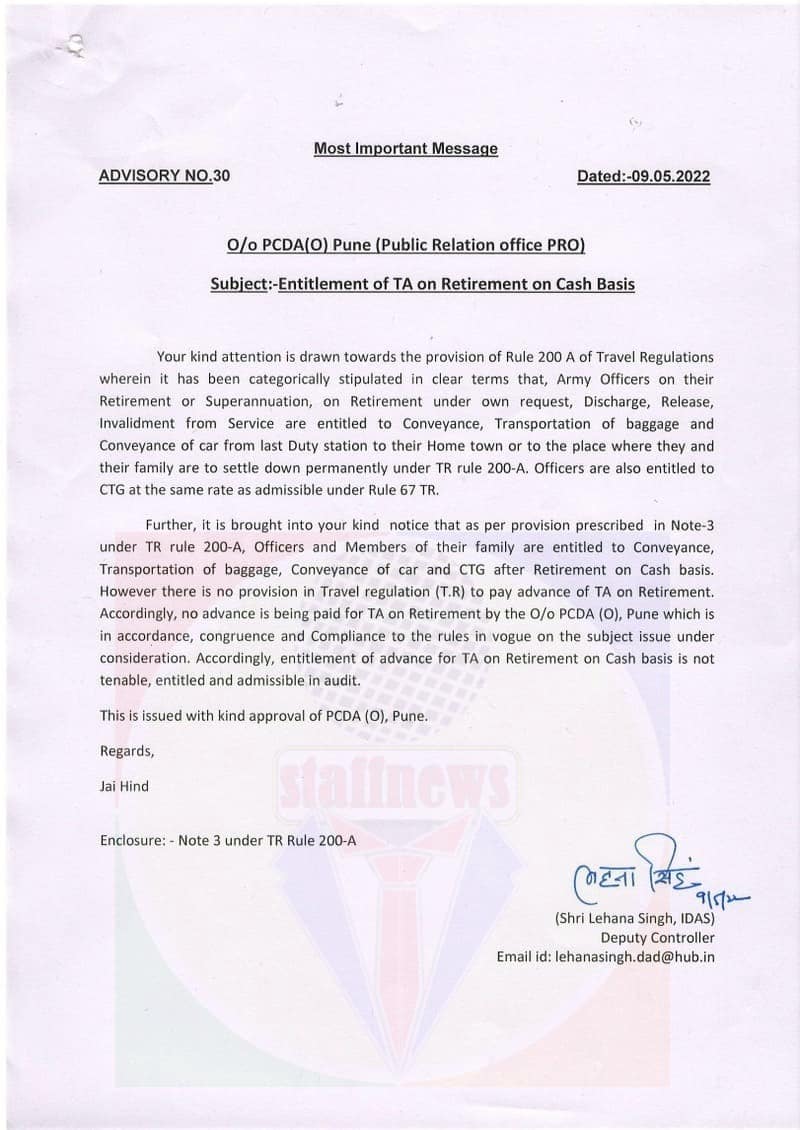

Most Important Message

ADVISORY NO.30

Dated:-09.05.2022

O/o PCDA(O) Pune (Public Relation office PRO)

Subject:-Entitlement of TA on Retirement on Cash Basis

Your kind attention is drawn towards the provision of Rule 200 A of Travel Regulations wherein it has been categorically stipulated in clear terms that, Army Officers on their Retirement or Superannuation, on Retirement under own request, Discharge, Release, Invalidment from Service are entitled to Conveyance, Transportation of baggage and Conveyance of car from last Duty station to their Home town or to the place where they and their family are to settle down permanently under TR rule 200-A. Officers are also entitled to CTG at the same rate as admissible under Rule 67 TR.

Further, it is brought into your kind notice that as per provision prescribed in Note-3 under TR rule 200-A, Officers and Members of their family are entitled to Conveyance, Transportation of baggage, Conveyance of car and CTG after Retirement on Cash basis. However there is no provision in Travel regulation (T.R) to pay advance of TA on Retirement. Accordingly, no advance is being paid for TA on Retirement by the O/o PCDA (O), Pune which is in accordance, congruence and Compliance to the rules in vogue on the subject issue under consideration. Accordingly, entitlement of advance for TA on Retirement on Cash basis is not tenable, entitled and admissible in audit.

This is issued with kind approval of PCDA (O), Pune.

Regards,

Jai Hind

Enclosure: – Note 3 under TR Rule 200-A

(Shri Lehana Singh, IDAS)

Deputy Controller

COMMENTS