Deduction/Non-deduction of TDS in SCSS accounts in post offices: SB Order No. 37/2021

SB Order No. 37/2021

F. No. FS-13/7/2020-FS

Government of India

Ministry of Communications

Department of Posts

(Financial Services Division)

Dak Bhawan New Delhi-110001

Dated: 22.11.2021.

To,

All Head of Circles/Regions,

Subject: – Deduction/Non-deduction of TDS in SCSS accounts in post offices reg.

Sir/Madam,

Reference is invited to this office even letter no. dated 15.09.2021, in which the detailed guidelines were issued for configuration of TDS related parameters in Finacle in respect of SCSS accounts.

Read also: Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices

2. This office is receiving representations from the SCSS account holder(s) that TDS amount has been deducted from their interest payments even after submission of form 15G/15H for the current Financial Year.

3. I am directed to say that Circles should take necessary action for configuration of TDS/Form 15G/15H/NOPAN status in all SCSS accounts and CIFs.

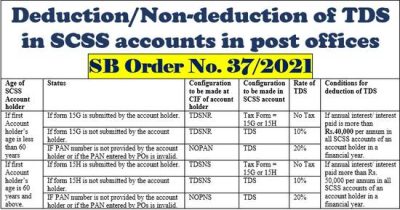

4. The updated guidelines are again reiterated in respect of configuration of TDS/15G_15H/No PAN in respect of Senior Citizens Savings Scheme (SCSS) accounts in Finacle for necessary action: –

- Whenever the SCSS account holder submits form 15G/15H, the concerned post office shall ensure that the details in customers CIF and SCSS account as prescribed in the table below.

- All CBS post offices shall ensure that all form 15G/15H already received are updated in Finacle, as TDS deduction is based on the information available in CIF and Account level.

- CIF of SCSS account holders should be seeded with valid PAN.

- TDS code is configured in CIF level for SCSS account holders. It should be TDSNR/TDSNS only and not as NOTAX

- Tax liability will be calculated based on the age of customer and interest payable for the financial year

- Tax exemption is applicable only if the account is seeded with 15G/15H

- TDS code NOTAX/TDSNR will be converted as TDSNS on the date of customer reaching 60 years of age, by a batch process.

- If PAN is invalid, TDS code will be converted as NOPAN/NOPNS by the batch process in Finacle.

- Updating of form 15G/15H should be done on the date of receipt of form from the account holder.

- 15G/15H should be updated using CSCAM menu and verified without fail.

- Once 15G/15H is entered, tax category at account level will get updated to ‘No Tax’.

5. The following configuration should be made by all the CBS post offices for configuration of TDS or non-deduction of TDS or NO PAN in all existing SCSS accounts or at the time of opening of new account in SCSS as the case may be:-

| Age of SCSS Account holder | Status | Configuration to be made at CIF of account holder | Configuration to be made in SCSS account | Rate of TDS | Conditions for deduction of TDS |

| If first Account holder’s age is less than 60 years | If form 15G is submitted by the account holder. | TDSNR | Tax Form = 15G or 15H | No Tax | If annual interest/ interest paid is more than Rs.40,000 per annum in all SCSS accounts of an account holder in a financial year. |

| If form 15G is not submitted by the account holder. | TDSNR | TDS | 10% | ||

| IF PAN number is not provided by the account holder or if the PAN entered by POs is invalid. | NOPAN | TDS | 20% | ||

| If first Account holder’s age is 60 years and above. | If form 15H is submitted by the account holder. | TDSNS | Tax Form = 15G or 15H | No Tax | If annual interest/ interest paid more than Rs. 50,000 per annum in all SCSS accounts of an account holder in a financial year. |

| If form 15H is not submitted by the account holder. | TDSNS | TDS | 10% | ||

| IF PAN number is not provided by the account holder or if the PAN entered by POs is invalid. | NOPNS | TDS | 20% |

6. Government of India has amended Section 194A of Income Tax Act, 1961 and accordingly the total aggregate interest income in a Financial Year payable in case of all SCSS account holders, who has not attained the age of 60 years has been revised and configured in Finacle from Rs. 10,000/- to Rs. 40,000/- for the purpose of TDS deduction.

7. Non-CBS post offices shall also deduct the TDS from the SCSS account holders aged below 60 years in accordance with the above revised limit.

8. It is the responsibility of concerned CBS post office for updation of form 15G/15H (if submitted) in every financial year and update correct PAN number. Quoting invalid PAN /wrong PAN number may attract penalty u/s 272B of Income Tax Act-1961.

9. It is requested to circulate these guidelines to all Post Offices for information, guidance and ensure necessary action.

10. This is issued with approval of the competent authority.

Yours Sincerely

(Devendra Sharma)

Assistant Director (SB-II)

COMMENTS