PFRDA Circular on Premature exit of NPS Lite Swavalamban Subscribers

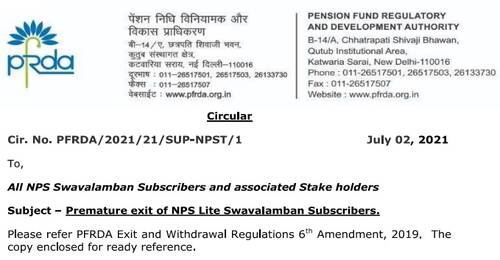

PENSION FUND REGULATORY

AND DEVELOPMENT AUTHORITY

B-14/A, Chhatrapati Shivaji Bhawan,

Qutub Institutional Area.

Katwania Sarai, New Delhi-110016

Circular

Cir. No. PFRDA/2021/21/SUP-NPST/1

July 02, 2021

To,

All NPS Swavalamban Subscribers and associated Stake holders

Subject — Premature exit of NPS Lite Swavalamban Subscribers.

Please refer PFRDA Exit and Withdrawal Regulations 6th Amendment, 2019. The copy enclosed for ready reference.

2. As per the 6th Amendment of Exit Regulations, the Swavalamban Subscribers whose accumulated pension wealth do not exceed one lakh rupees and if they are not eligible to migrate to Atal Pension Yojana (APY), can opt to prematurely exit with lump sum payment.

3. Those eligible Subscribers as mentioned above are not required to continue in the Swavalmban scheme for minimum period of twenty-five years irrespective of the receipt of Govt of India (Gol) co-contribution under Swavalamban by them. However, if GoI’s co-contribution was availed by those eligible Subscribers and the same shall be deducted along with the returns generated from the corpus at the time of their exit.

4. The accumulated corpus of those Swavalamban Subscribers as mentioned in point no (2) is to be calculated after deducting Government’s co-contribution, if any, and the returns thereon.

This circular is issued under section 14 of PFRDA Act 2013 and is available at PFRDA’s website (www.pfrda.org.in) under the Regulatory framework in “Circular” section.

Yours sincerely

K. Mohan Gandhi

General Manager

k.mohangandhi[at]pfrda.org.in

The Gazette of India

EXTRAORDINARY

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

NOTIFICATION

New Delhi, the 20th September, 2019

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY (EXITS AND WITHDRAWALS UNDER THE NATIONAL PENSION SYSTEM) (SIXTH AMENDMENT) REGULATIONS, 2019

No. PFRDA/12/RGL/139/8.— In exercise of the powers conferred by sub-section (1) of Section 52 read with sub-clause(g), (h), and (1) of sub-section 2 of Section 52 of the Pension Fund Regulatory and Development Authority Act, 2013 (Act No.23 of 2013), the Pension Fund Regulatory and Development Authority hereby makes the following regulations to amend the Pension Fund Regulatory and Development Authority (Exits and Withdrawals under the National Pension System) Regulations, 2015 namely, –

- These regulations may be called the Pension Fund Regulatory and Development Authority (Exits and Withdrawals under the National Pension System) (Sixth Amendment) Regulations, 2019.

- These shall come into force on the date of their publication in the official gazette.

- In the Pension Fund Regulatory and Development Authority (Exits and Withdrawals under the National Pension System) Regulations, 2015:-

Read also: Swavalamban Yojana a co-contributory Scheme

(I). Second and Third proviso to Sub regulation (b) of Regulation 5 shall be substituted as below-

Provided further that, where the accumulated pension wealth does not exceed one lakh rupees or a limit to be specified by the Authority, the whole pension wealth shall be paid without annuitisation to the subscribers who have not availed any Swavalamban co-contribution, and also to the subscribers who though have availed Swavalamban co-contribution but are not eligible for auto migration to Atal Pension Yojana, after deducting the Government’s co-contribution with returns thereon without requiring them to continue in the scheme for minimum period of twenty-five years.

Explanation— The migration of a Swavalamban subscriber to any other pension scheme of Government of India, including Atal Pension Yojana, as approved by the Authority, shall not be deemed as an exit and withdrawal for the purposes of these regulations.

RAVI MITAL, Chairperson

[ADVT-III/4/Exty./2 19/19

COMMENTS