COVID-19 Outbreak: No proposal to reduce salary and pension of Central Govt Employees, clarification by Govt.

COVID-19 Outbreak: No proposal to reduce salary and pension of Central Govt Employees, clarification by Govt.

The Finance Ministry has clarified that [...]

Refund of air fare during the lockdown period: Ministry of Civil Aviation Order

Refund of air fare during the lockdown period, suspending domestic and international flight operations: Ministry of Civil Aviation Order

GOVERNMENT O [...]

CGHS Order on Social Distancing – 9 points guidelines and protocol to be followed at CGHS Wellness Centres/ Units

CGHS Order on Social Distancing - 9 points guidelines and protocol to be followed at CGHS Wellness Centres/ Units - Advisory in view of the Corona Vir [...]

Railway Board: Office will functional from 20.04.2020, Hotspot areas resident will not attend office

Railway Board Office Order No. 25 of 2020: Office will functional from 20.04.2020 onwards. Those residing in Hotspot areas will not attend office

भार [...]

COVID 19 Lockdown: Ministry of Defence Order – Office will remain open without restriction w.e.f. 20.04.2020

COVID 19 Lockdown: Ministry of Defence Order - Office will remain open without restriction w.e.f. 20.04.2020

F.No. A-50024/01/2020-D[Estt.I/Gp.I]

Go [...]

SB Order No. 17/2020: Introduction of National Savings Schemes Common/Modified Forms

SB Order No. 17/2020: Introduction of common/modified forms to be used in National Savings Schemes for CBS and non CBS Post Offices

SB Order No. 17/2 [...]

Covid19 Lockdown-2: Order to open the Offices of Govt. of India, its Autonomous/Subordinate offices w.e.f. 20 April 2020

Covid-19 Lockdown-2: Order to open the Offices of Govt. of India, its Autonomous/Subordinate offices w.e.f. 20 April 2020: CBIC Order in light of MHA [...]

Postal Life Insurance Gazette Notification: Rates of Bonus for the Financial Year 2020-21 from 01.04.2020

Postal Life Insurance Gazette Notification: Rates of Bonus for the Financial Year 2020-21 will be applicable from 01.04.2020

MINISTRY OF COMMUNIC [...]

Income other than business or profession – Clarification on option u/s 115BAC of IT Act 1961: Circular C1 of 2020

Income other than business or profession - Clarification on option u/s 115BAC of IT Act 1961: Income Tax Circular C1 of 2020 dated 13.04.2020 issued b [...]

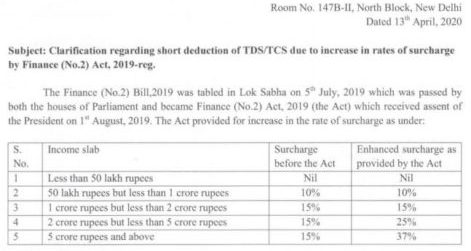

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]