Income Tax: Basic exemption limit on the income under the Finance Act, 2019

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

LOK SABHA

UNSTARRED QUESTION NO. 127

TO BE ANSWERED ON

MONDAY 3rd JANUARY, 2020

MAGHA 14, 1941 (SAKA)

INCOME TAX EXEMPTION

127. JASBIR SINGH GILL:

Will the Minister of FINANCE be pleased to state:

(a) whether it is a fact that the Government has decided any limit for exemption of Income Tax;

(b) if so, the details thereof;

(c) the details of limit of exemption of Income Tax before the general election of 2019; and

(d) the time by which exemption limit of Rs.5 lacs would be implemented?

ANSWER

THE MINISTER OF STATE IN MINISTRY OF FINANCE (SHRI ANURAG SINGH THAKUR)

(a) and (b): The Finance Act of respective years, inter-alia, provides for the rates of income-tax as well as the basic exemption limit on the income of individuals, Hindu undivided family, association of persons or body of individuals, artificial juridical person as defined under the Income-tax Act, 1961 (the Act). The Finance Bill prior to its enactment as an Act, is tabled before the Parliament during the Union Budget which is being presented every year in Lok Sabha on 1st February since 2017.

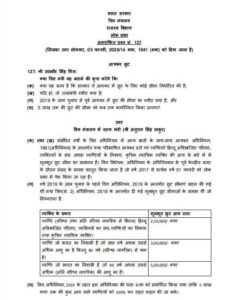

(c) Before the general election of 2019, the exemption limits were provided under the Finance Act, 2019 and were the same as the basic exemption limits as provided under the Finance (No. 2) Act, 2019 which is as below:

|

Nature of Person |

Basic Exemption Income Level |

|

Individual (other than senior and very senior citizen), HUF, association of persons, body of individuals and artificial juridical person. |

Rs 2,50,000/- |

|

Individual, resident in India who is of the age of sixty years or more but less than eighty years. (senior citizen) |

Rs 3,00,000 |

|

Individual, resident in India who is of the age of eighty years or more. (very senior citizen) |

Rs 5,00,000 |

(d) Vide Finance Act, 2019, section 87A of the Act was amended to provide a 100% tax rebate to individuals having total income up to Rs. 5 lakhs.

COMMENTS