Allocation of funds for 20% Interim Relief & 100% DA Merger: CTU writes to FM

"Proper allocation of funds be made for interim relief of 20% and 100% DA merge with basic pay and allowances including neutralization percentage be [...]

Guidelines for Educational Qualifications and Experience for framing/ amendment of Recruitment Rules

No.AB-14017/ 27/2014-Estt.(RR)

Government of India

Ministry of Personnel P.G.& Pensions

Department of Personnel & Training

North Block, [...]

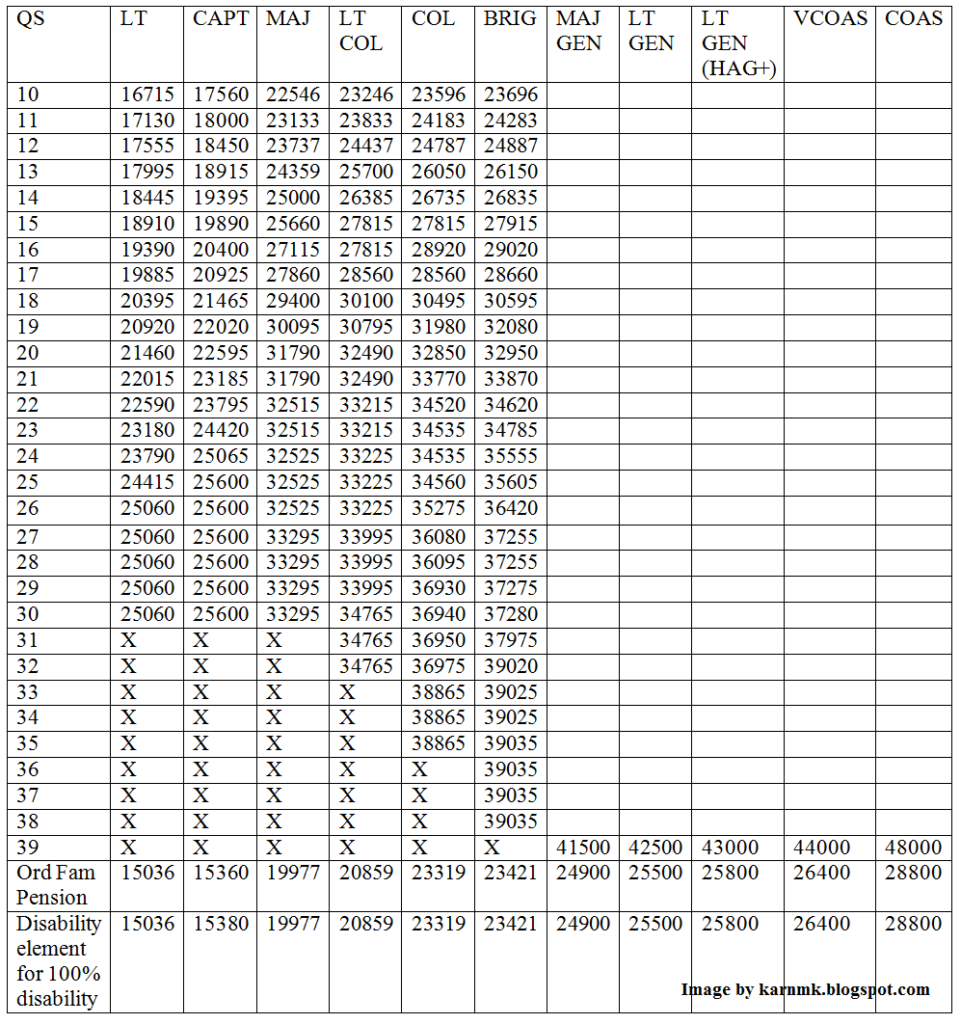

Where is the OROP heading – OROP Table in Circulation

Where is the OROP heading

It is with considerable interest that I read the musings/op ed of Brig V Mahalingam (retd), a noted TV debater/expert an [...]

Incomes not included under the Head Salaries (Exemptions) – Income Tax on Salaries Circular 17/2014

5.3 INCOMES NOT INCLUDED UNDER THE HEAD "SALARIES" (EXEMPTIONS)

Any income falling within any of the following clauses shall not be included in compu [...]

Illustrations – For Assessment Year 2015-16: Income Tax on Salaries Circular No. 17/2014

INCOME TAX ON SALARIES: Circular No. 17/2014

SOME ILLUSTRATIONS

Example 1

For Assessment Year 2015-16

(A) Calculation of Income tax in the ca [...]

Deduction u/s 16, Chapter VI-A : Income Tax on Salaries Circular No. 17/2014

Deduction u/s 16, Chapter VI-A(80-C, 80CCC, 80CCD, 80CCG, 80D, 80DD, 80U, 80DDB, 80E, 80EE, 80GG, 80GGA, 80TTA) & 87A: Income Tax on Salaries Cir [...]

Definition of Salary, Perquisite and Profit in lieu of Salary (Section 17): Income Tax on Salaries Circular No. 17/2014

5.2 DEFINITION OF “SALARY”, “PERQUISITE” AND “PROFIT IN LIEU OF SALARY” (SECTION 17):

Click to view Part I

Income Tax on Salaries - Ci [...]

Computation of Income Tax – Income Chargeable Under the Head Salaries: Income Tax on Salaries Circular 17/2014

5. COMPUTATION OF INCOME UNDER THE HEAD "SALARIES"

5.1 INCOME CHARGEABLE UNDER THE HEAD "SALARIES":

Click to view Part I

Income T [...]

Persons responsible for Deducting Tax and their Duties: Income Tax on Salaries Circular 17/2014

4. PERSONS RESPONSIBLE FOR DEDUCTING TAX AND THEIR DUTIES:

Click to view Part I

Income Tax on Salaries - Circular No. 17/2014

[...]

Scheme of Tax Deduction at Source from Salaries – Circular No. 17/2014

3. SECTION 192 OF THE INCOME-TAX ACT, 1961: BROAD SCHEME OF TAX DEDUCTION AT SOURCE FROM "SALARIES":

3.1 Method of Tax Calculation:

[...]